Saving Behavior of Thai Elderly

Keywords:

Elderly, Saving, Saving AdequacyAbstract

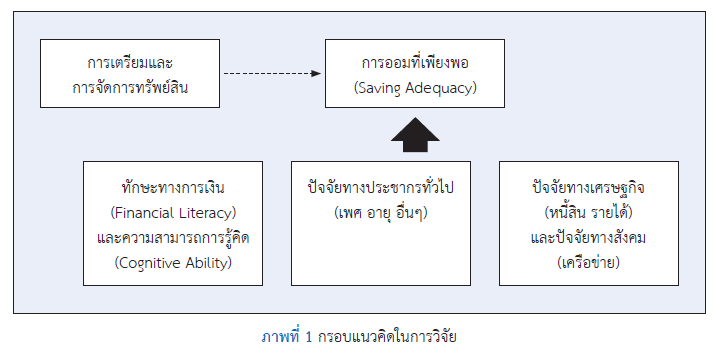

Demographic transitions have heightened the importance of understanding savings adequacy among the elderly as a key component of policy design to address population aging. In Thailand, where the elderly population is expanding rapidly amid middle-income status and fiscal constraints, this study investigates the economic and social determinants of savings adequacy for older individuals. Specifically, the analysis tests the role of financial literacy and cognitive ability in influencing adequate savings, while also examining the demand for asset management assistance. Utilizing survey data from 1,010 individuals aged 55 to 75 across representative provinces, the findings indicate that occupation, income, and health status are significant predictors of savings adequacy. Contrary to theoretical expectations, neither financial literacy nor cognitive ability exhibits a statistically significant association with adequate savings. Furthermore, demand for asset management assistance is primarily observed among elderly individuals with outstanding debt, while low income and limited social capital are not significant drivers of such demand. These results underscore the multifaceted nature of savings behavior among the elderly, shaped by economic, social, and health factors. The findings suggest that policy interventions aimed at enhancing retirement preparedness should adopt an integrated approach, as financial education alone may be insufficient to improve savings outcomes.

References

Agarwal, S., Driscoll, J. C., Gabaix, X., & Laibson, D. (2009). The age of reason: Financial decisions over the life-cycle with implications for regulation. Brookings Papers on Economic Activity, (2), 51-117. https://doi.org/10.1016/j.jebo.2009.02.010

Ameriks, J., Caplin, A., & Leahy, J. (2007). Retirement consumption: Insights from a survey. The Review of Economics and Statistics, 89(2), 265-274. https://doi.org/10.1162/rest.89.2.265

Ballinger, T. P., Hudson, E., Karkoviata, L., & Wilcox, N. T. (2011). Saving behavior and cognitive abilities. Experimental Economics, 14, 349-374. https://doi.org/10.1007/s10683-010-9271-3

Banks, J., Blundell, R., & Tanner, S. (1998). Is there a retirement-savings puzzle? The American Economic Review, 88(4), 769-788.

Benedict, S. K. K., Mitchell, O. S., & Rohwedder, S. (2020). Financial knowledge and portfolio complexity in Singapore. The Journal of the Economics of Ageing, 17, Article 100179. https://doi.org/10.1016/j.jeoa.2018.11.004

Bernheim, B. D., Skinner, J., & Weinberg, S. (2001). What accounts for the variation in retirement wealth among U.S. households? The American Economic Review, 91(4), 832-857. https://doi.org/10.1257/aer.91.4.832

Burks, S. V., Lewis, C., Kivi, P. A., & Wiener, A., Anderson, J. E., Götte, L., DeYoung, C. G., & Rustichini, A., (2015). Cognitive skills, personality, and economic preferences in collegiate success). Journal of Economic Behavior & Organization, Elsevier, 115(C), 30-44. https://doi.org/10.1016/j.jebo.2015.01.007

Clark, R. L., Lusardi, A., & Mitchell, O. S. (2017). Financial knowledge and 401(k) investment performance. Journal of Pension Economics and Finance, 16(3), 324-347. https://doi.org/10.1017/S1474747215000384

Cole, S., Paulson, A., & Shastry, G. K. (2014). Smart money? The effect of education on financial outcomes. The Review of Financial Studies, 27(7), 2022-2051. https://doi.org/10.1093/rfs/hhu012

Cole, S., Sampson, T., & Zia, B. (2011). Prices or knowledge? What drives demand for financial services in emerging markets? The Journal of Finance, 66(6), 1933-1967. https://doi.org/10.1111/j.1540-6261.2011.01696.x

Fafchamps, M., & Lund, S. (2003). Risk-sharing networks in rural Philippines. Journal of Development Economics, 71(2), 261-287. https://doi.org/10.1016/S0304-3878(03)00029-4

Fisch, J. E., Lusardi, A., & Hasler, A. (2020). Defined contribution plans and the challenge of financial illiteracy. Cornell Law Review, 105(3). https://scholarship.law.cornell.edu/clr/vol105/iss3/5

Fong, J. H., Koh, B. S. K., Mitchell, O. S., & Rohwedder, S. (2021). Financial literacy and financial decision-making at older ages. Pacific-Basin Finance Journal, 65, Article 101481. https://doi.org/10.1016/j.pacfin.2020.101481

Frederick, S. (2005). Cognitive reflection and decision making. Journal of Economic Perspectives, 19(4), 25-42. https://doi.org/10.1257/089533005775196732

Gomes, F., Kenton, H., Wei-Yin, H., & Enrichetta, R. (2020). Retirement savings adequacy in U.S. defined contribution plans. Working Paper Series WP 2022-40, Federal Reserve Bank of Chicago. https://doi.org/10.21033/wp-2022-40

Gongkhonkwa, G. (2022). Financial attitude and factors affecting savings of the elderly in Phayao province. NIDA Business Journal, (27), 76-97. https://so10.tci-thaijo.org/index.php/NIDABJ/article/view/100

Grohmann, A. (2018). Financial literacy and financial behavior: Evidence from the emerging Asian middle class. Pacific-Basin Finance Journal, 48, 129-143. https://doi.org/10.1016/j.pacfin.2018.01.007

Janposri, P. (2020). The role of financial literacy in retirement planning and wealth accumulation among self-employed Thai workers. Journal of Population and Social Studies, 29, 177-194. https://doi.org/10.25133/JPSSv292021.011

Jiwpattanakul, A. (2010). Factors influencing the saving and spending behaviors of the elderly. Research and Development Journal, Srinakharinwirot University, 3(6), 178-194.

Kim, H. H., Maurer, R., & Mitchell, O. S. (2021). How financial literacy shapes the demand for financial advice at older ages. The Journal of the Economics of Ageing, 20, Article 100329. https://doi.org/10.1016/j.jeoa.2021.100329

Koh, B. S. K., Mitchell, O. S., & Rohwedder, S. (2020). Financial knowledge and portfolio complexity in Singapore. The Journal of the Economics of Ageing, 17, Article 100179. https://doi.org/10.1016/j.jeoa.2018.11.004

Lusardi, A., & Mitchell, O. S. (2007). Financial literacy and retirement preparedness: Evidence and implications for financial education. Business Economics, 42(1), 35-44. https://doi.org/10.2145/20070104

Lusardi, A., & Mitchell, O. S. (2011). Financial literacy around the world: An overview. Journal of Pension Economics and Finance, 10(4), 497-508. https://doi.org/10.1017/S1474747211000448

Lusardi, A., & Mitchell, O. S. (2014). The economic importance of financial literacy: Theory and evidence. Journal of Economic Literature, 52(1), 5-44. https://doi.org/10.1257/jel.52.1.5

Lusardi, A., & Mitchell, O. S. (2017). How ordinary consumers make complex economic decisions: Financial literacy and retirement readiness. Quarterly Journal of Finance, 7(3), 1-31. https://doi.org/10.1142/S2010139217500082

Lusardi, A., & Mitchell, O. S. (2023). The importance of financial literacy: Opening a new field. Journal of Economic Perspectives, 37(4), 137-154. https://doi.org/10.1257/jep.37.4.137

Lusardi, A., & Tufano, P. (2015). Debt literacy, financial experiences, and over indebtedness. Journal of Pension Economics and Finance, 14(4), 332-368. https://doi.org/10.1017/S1474747215000232

Lusardi, A., Mitchell, O. S., & Oggero, N. (2020). Debt and financial vulnerability on the verge of retirement. Journal of Money, Credit and Banking, 52(5), 1005-1034. https://doi.org/10.1111/jmcb.12671

Modigliani, F. (1966). The life cycle hypothesis of savings, the demand for wealth, and the supply of capital. Social Research, 33(2), 160-217.

Modigliani, F., & Brumberg, R. (1954). Utility analysis and the consumption function: An interpretation of cross-section data. In K. K. Kurihara (Ed.), Post Keynesian economics (pp. 388-436). Rutgers University Press.

Van Rooij, M. C. J., Lusardi, A., & Alessie, R. J. M. (2011). Financial literacy and stock market participation. Journal of Financial Economics, 101(2), 449-472. https://doi.org/10.1016/j.jfineco.2011.03.006

Van Rooij, M. C. J., Lusardi, A., & Alessie, R. J. M. (2012). Financial literacy, retirement planning, and household wealth. The Economic Journal, 122(560), 449-478. https://doi.org/10.1111/j.1468-0297.2012.02501.x

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 NIDA Business School, National Institute of Development Administration

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.