Financial Attitude and Factors Affecting Savings of the Elderly in Phayao Province

Keywords:

Financial attitude, Savings, ElderlyAbstract

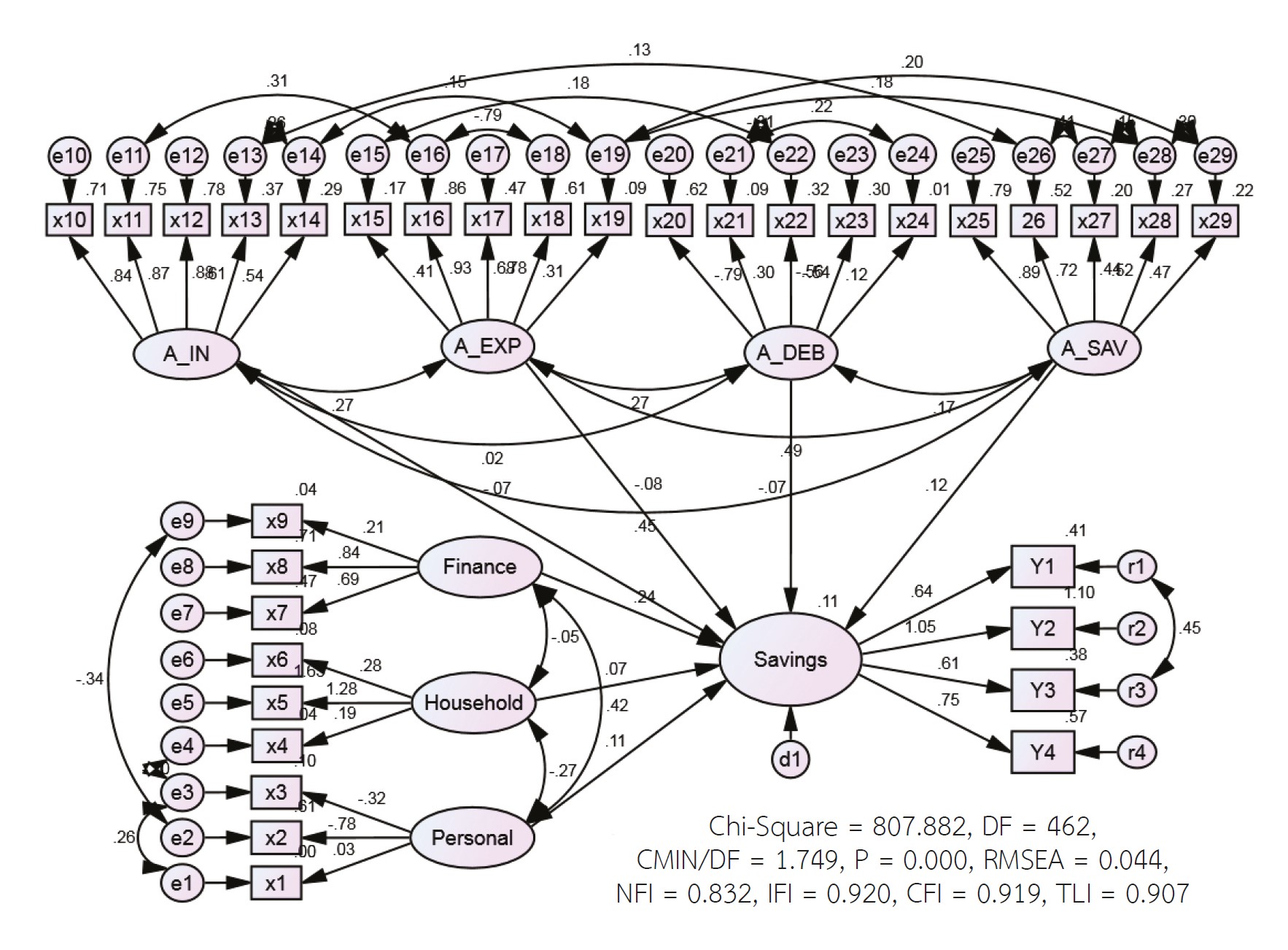

An increasing of the aged in the society of Thailand is an important issue which everyone should pay attention to in financial planning for retirement. Many previous studies have found that most elderly people in Thailand are facing financial problems, such as no incomes and no savings; which causes their life after retirement to become more unstable. Therefore, the purposes of the present research are: 1) to measure the level of financial attitude and, 2) to investigate the causal factors influencing savings. The research was conducted using a multi-stage sampling technique on 387 participants, aged over sixty years old and living in Phayao province. The data were collected by questionnaire, including socio-demographics, savings information, and financial attitudes. Structural equation modeling (SEM) was used to represent the relationships of factors which the results found:

- Incomes attitudes and savings attitudes of the elderly in Phayao province were at the highest level; which is a good sign because both incomes and savings attitudes have a positive relationship on saving. However, expenditures attitudes and debts attitudes were at the moderate level; which is a bad sign because expenditures and debts attitudes have a negative relationship on saving.

- The causal relationship model found that both socio-demographic and financial attitude affect saving by the elderly in Phayao province. Moreover, there are two factors that have the greatest effect on savings; financial information, and savings attitudes.

References

Anongnart Supakitvanitchkul and Prasopchai Phasunon. (2016). A comparison of savings behavior and the financial management before the retirement: case study of the stuffs in Silpakorn University, Verridian E-journal, Silpakorn University, 9(2), 375-389.

Apichaya Chiewpattanakul, Warangkana Adisornprasert, and Supinya Yansomboon. (2011). Factors affecting saving behavior and spending behavior of senior citizen, Srinakharinwirot research and development, 3(6), 178-194.

Arrai Mungtat. (2006). Personal Finance (1st) Bangkok: Wangaksorn Publishing.

Arthur J. Keown. (2013). Personal Finance (6th edition). United States: Pearson Education.

Charawee Butbumrung. (2012). “The income and pattern of saving for readiness toward old-age of people age between 30-40 year in Dusis Districk Bangkok, Suan Sunandha Rajabhat University” Retrieved January 25, 2018, from http://mba.nida.ac.th/th/books/read/77efd2e0-9943-11e7-9f 8b-935415 e906a8.

Department of Older Person. (2016). “Number of the Thai elderly 2016” Retrieved February 11, 2018, from http://www.dop.go.th/download/knowledge/knowledge_th_20170707092742_1.pdf.

Information and communication technology center. (2015). Poverty of the elderly. Retrieved February 13, 2018, from https://www.m-society.go.th/article_attach/14086/17913.pdf.

Kanlaya Vanichbuncha. (2013). Structural equation modeling (SEM) analysis with AMOS (1st) Bangkok: Samlada Partnership Limited (Part., Ltd.).

Krejcie R. V. and Morgan, D. W. (1970). Determining Sample Size for Research activities. Educational and Psychological Measurement, 30(3), pp.607-610.

Nuttitta Devalersakul, Wanida Siriwarakoon, and Chartsarun Roadyim. (2016). The development of the elderly as a burden to power: case study of Rangsit City Municipality, Verridian E-journal, Silpakorn University, 9(1), 529-545.

Office of the national economic and social development board. Thailand population estimates from 2010-2040, Retrieved February 11, 2018, from http://social.nesdb.go.th/ social/Portals/0/Documents/e-book.pdf.

Pichitra Nuchnum and Phitak Siriwong. (2015). The meaning and origin of saving, saving process, saving problems and obstacles based on the philosophy of sufficiency economy of government officials of Kanchanaburi provincial administration organization, Verridian E-journal, Silpakorn University, 8(1), 398-415.

Poomthan Rangkakulnuwat. (2016). Macroeconomics theory II (1st). Bangkok: Chulalongkorn University Press.

Ratchanikon Wongchan. (2015). Personal financial planning (3rd). Bangkok: Boonsiri printing Co., Ltd.

Saneeyah Changwattanakun. (2016). Influent factors to saving behavior of the Satun people, Master thesis, Prince of Songkla University.

Saowanee Boonto. (2012). Consumer behavior (2nd). Bangkok: Triple Group Co., Ltd. (in Thai)

Siwaporn Karawanun. (2014). Money loan agreement. Retrieved February 13, 2018, from http:// lawwebservice.com/learning2/mod/forum/discuss. php?d=49.

Somnuk Aujirapongpan and Punn Kao-iean. (2015). Factors influencing personal financial management of Chumphon provincial police, Journal of management sciences, 32(2), 29-57.

Stock Exchange of Thailand. (2018). “4 Financial attitudes” Retrieved February 12, 2018, from http://www.maruey.com/article/contentinbook0034.html.

Sudarat Pimonratanakan. (2012). Personal finance (1st). Bangkok: Se-Ed book center Co., Ltd.

Sudarat Pimonratanakan, Naruemon Jituea, and Thirawat Chantuk. (2017). Motivation factors for money saving environment saving and attitudes saving which affect college of logistics and supply chain Suansunandha Rajabhat University, Srinakharinwirot Business Journal, 8(2), 26-41.

Sukjai Namput, Anuchanat Jaroenjitrkarn, and Somnuk Wiwathana. (2014). Strategic personal finance management (6th). Bangkok: Se-Ed book center Co., Ltd.

Supachai Srisuchart. (2012). Labor policy and aging society. Thammasat University. Retrieved February 5, 2018, from http://www.econ.tu.ac.th/oldweb/doc/news/409/econtu_63_suphachai.pdf.

Supamas Angsuchoti and Kanjanee Kangwanpornsiri. (2015). Approaches and measures in promoting elder saving in accordance with philosophy of the sufficiency economic: a case study of Nonthaburi province, Srinakharinwirot research and development, 7(14), 146-158.

Technical promotion and support office 1-12. (2016). Strategies to promote financial saving in adulthood to prepare for senior-hood, Retrieved February 5, 2018, from http://tpso12.m-society.go.th/th/images/PDF_Data_Load/VICHAKARN.pdf.

Thaworn Sakunphanit. (2011). “Performance of health care for elderly and impact on public health care financing during 2011-2022. Thai health promotion foundation” Retrieved February 8, 2018, from http://kb.hsri.or.th/dspace/handle/11228/3495?show=full.

Viroj Jadesadalug and Thanaporn Nuangplee. (2018). Behavior and facto affecting saving of the elders in Muang district, Nonthaburi province. Verridian E-journal, Silpakorn University, 11(1), 3061-3074.

Wandee Hirunsathaporn, Suratchada Makhala, Krittika Ma-in, and Wutthichai Limarunothai. (2013). The efficiency of savings’s elderly people in Bangkok, Rajamangala University of Technology Rattanakosin. Retrieved January 30, 2018, from http://repository.rmutr.ac.th/bitstream/handle/123456789/535/Fulltext.pdf?sequence=1&isAllowed=y.

Wilai Auepiyachut. (2017). Financial literacy: determinants and its implications for saving behavior, Journal of humanities and social sciences, 25(47), 67-93.

Wirunsiri Jaima. (2014). Microeconomics I (4th). Bangkok: Chulalongkorn University Press.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2020 NIDA Business School, National Institute of Development Administration.

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.