The Influencing of Corporate Governance, Disclosures Quality, Dividend Policy and Earning Management on Information Asymmetry in Covid-19 Crisis

Keywords:

data asymmetry, corporate governance, disclosure quality, dividend policy, profit managementAbstract

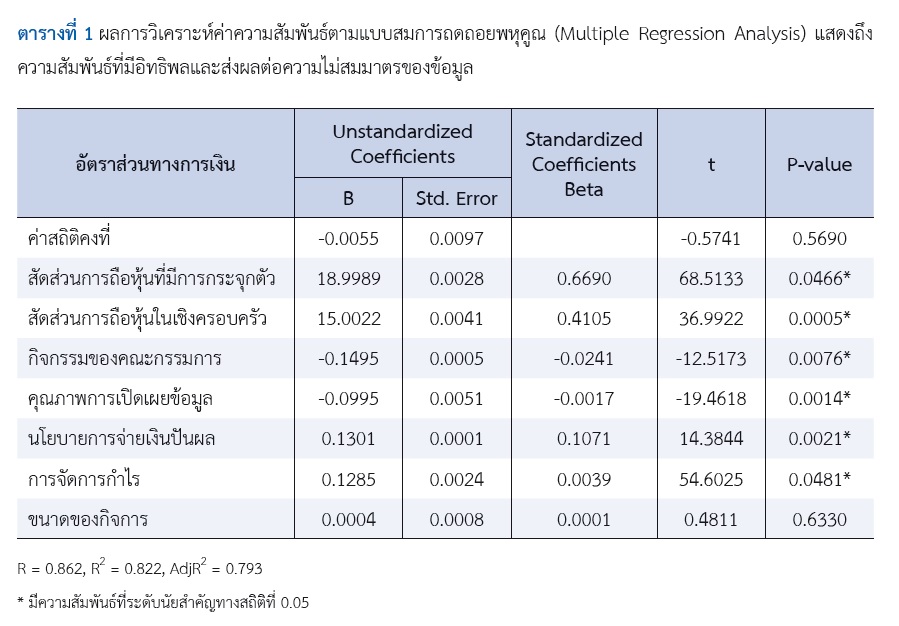

The research endeavors to investigate the impact of effective corporate governance, disclosure quality, dividend payment policies, and profit management on data asymmetry amid the COVID-19 crisis. Its objective is to scrutinize and elucidate the determinants influencing data asymmetry within the medical services sector of the Stock Exchange of Thailand. The aim is twofold: firstly, to anticipate the emergence of data asymmetry during the COVID-19 pandemic; secondly, to ascertain the continued efficacy of data asymmetry assessments given the evolving circumstances. Demographic data were compiled from pertinent associations within the medical services industry, focusing on 22 businesses listed on the Stock Exchange of Thailand, totaling 66 organizations, over the accounting period spanning from 2019 to 2021. The study employed statistical models and assessments of data asymmetry, building upon prior research conducted by Sincharoonsak and Kornlert (2022). The evaluation aimed to determine the predictive accuracy of the model in forecasting outcomes and assessing the asymmetry of the gathered data amidst the COVID-19 anomaly. Notably, the predictive model exhibited a direct influence confidence level of 79.30%, surpassing previous research, which yielded a combined confidence level for both direct and indirect influences at 32%. These findings underscore the predictive model's capacity to anticipate data asymmetry even amid the COVID-19 crisis.

References

Akerlof, G. .A. (1970). "The market for 'Lemons'. Quality, Uncertainty and Market Mechanism" Quarterly Journal of Economics, Vol. 84(3), 488-500. https://doi.org/10.2307/1879431

Alamdari, N. N. (2016). "Relationship between Information Asymmetry and Dividend Policy of Companies Listed in TSE." International Journal of Arts-based Educational Research. Vol14(10), 7043-7054. https://serialsjournals.com/abstract/54479_ch-57_afra_1.pdf

Alves, H. S. A. (2011). "Corporate Governance Determinants of Voluntary Disclosure and its Effect on Information Asymmetry: An Analysis for Iberian Peninsula Listed Companies." Faculty of Economic. University of Coimbra. 1-401. https://citeseerx.ist.psu.edu/document?repid=rep1&type=pdf&doi=6e806477522ca82797705f7944343b84a058d730

Bhattacharya, N., Ecker, F., Olsson, P. M. and Schipper, K. (2012). "Direct and Mediated Associations among Earnings Quality, Information Asymmetry, and the Cost of Equity." The Accounting Review. Vol. 87(2), 449-482. https://doi.org/10.2308/accr-10200

Brandenburg, W. H. J. M. and Suijs, J. P. M. (2013). "Voluntary Disclosure and Information Asymmetry in the Netherlands." University of Tilburg. 1-31. https://arno.uvt.nl/show.cgi?fid=132112

Cerqueira, A. and Pereira, C. (2015). "Accounting Accruals and Information Asymmetry in Europe." Prague Economic Papers. Vol. 24(6), 638-661. https://doi.org/10.18267/j.pep.528

Fathi, J. (2013). "Corporate Governance and the Level of Financial Disclosure by Tunisian Firm." Journal of Business Studies Quarterly. Vol.4(3), 95-111. https://citeseerx.ist.psu.edu/document?repid=rep1&type=pdf&doi=acccc2c78fd92849f21cc3f31b8e9293fb2c255a

Farber, D. B. (2004). "Restoring Trust After Fraud: Does Corporate Governance Matter?" The Accounting Review. Vol.80(2), 1-41. https://jstor.org/stable/4093068. https://doi.org/10.2308/accr.2005.80.2.539

Gonzalez, J. S. and Meca, E. G. (2013). "Does Corporate Governance Influence Earning Management in Latin American Markets?." Journal of Business Ethics. Vol.121, 419-440. https://doi.org/10.1007/s10551-013-1700-8

Jensen C. Michael. (1986). Agency Costs of Free Cash Flow, Corporate Finance, and Takeovers. The American Economic Review. Vol.76 (2), 323-329. https://jstor.org/stable/1818789

Jensen C. Michael and Mocking H. William. (1976). "Theory of the Firm: Managerial Behavior Agency Costs and Ownership Structure." Journal of Financial Economics. Vol. 3(4), 305-360. https://doi.org/10.1016/0304-405X(76)90026-X

Kornlert, P. and Sincharoonsak, T. (2022). The Research and Development of Information Asymmetry Assessment. International Journal of Economics and Finance Studies. Vol. 14 (3), 227-248. https://doi.org/10.34109/ijefs.20220071

Kornlert, P. and Penvutikul, P. (2022). The Analysis of Causal Influencing on Information Asymmetry of Listed on the Stock Exchange of Thailand. International Journal of eBusiness and eGovernment Studies. Vol.14(3), 99-119. https://doi.org/ 10.34109/ijebeg. 202214185

Kothari, S. P., Leone, A. J., and Wasley, C. E. (2005). Performance Matched Discretionary Accrual Measures. Journal of Accounting and Economics. Vol.39 (1), 163-197. https://doi.org/10.1016/j.jacceco.2004.11.002

Monnakgotla Zanele. (2014). "A Comparative Analysis of the Abnormal Returns Made by Acquirers in Acquisitions on the Johannesburg Securities Exchange South Africa (JSE)." [Master's thesis, University of the Witwatersrand]. Johannesburg. 1-105. https://wiredspace.wits.ac.za/server/api/core/bitstreams/2a9a87ba-e3ef-417a-a933-cec5261a9d17/content

Petersen, C. and Plenborg, T. (2006). "Voluntary Disclosure and Information Asymmetry in Denmark." Journal of International Accounting, Auditing and Taxation. Vol.15 (2), 127-149. https://doi.org/10.1016/j.intaccaudtax.2006.08.004

Palazzo, F. and Zhang, M. (2017). "Information Disclosure and Asymmetric Speed of Learning in Booms and Busts." Economics Letters. Vol.158, 7-40. https://doi.org/10.1016/j.econlet.2017.06.027

Raithatha, M. and Bapat, V. (2014). "Impact of Corporate Governance on Financial Disclosures: Evidence from India." Corporate Ownership and Control. Vol.12 (1), 874-889. https://doi.org/10.22495/cocv12i1c9p10

Sahar, M. E. and Mayahi, N. (2014). "Asymmetric Information and Dividend Payout Policy: Evidence from Iran Stock Exchange." Indian Journal of Fundamental and Applied Life Sciences. Vol.4(1), 30-35. https://cibtech.org/sp.ed/jls/2014/01/00(4).pdf

Shroff, N., Sun, A. X.,White, H. D. and Zhang, W. (2013). "Voluntary Disclosure and Information Asymmetry: Evidence from the 2005 Securities Offering Reform." Journal of Accounting Research. Vol.51(5), 1299-1345. https://doi.org/10.1111/1475-679X.12022

Securities and Exchange Commission. (2015). Corporate Governance Policy of the Stock Exchange of Thailand Group. Retrieved December 30, 2023, https://www.set.or.th/th/about/overview/cg

Wang, Q., Wong, T. J. and Xia, L. (2008). "State Ownership, The Institutional Environment, and Auditor Choice: Evidence Form China." Journal of Accounting and Economics. Vol.46 pp. 112-134. https://doi.org/10.1016/j.jacceco.2008.04.001

Ziabari, A. Z., Samadi, M., Meshki, M. and Masouleh, H. P. (2014). "Study of the Relationship between Information Asymmetry and Cash Dividend Policy." Management and Administrative Sciences Review. Vol.3(4), pp. 615-623.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 NIDA Business School, National Institute of Development Administration

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.