Returns and their persistence from investing in active Long Term Equity Funds and active equity Retirement Funds

Keywords:

Long-Term Equity Funds, Equity Retirement Mutual Funds, Fund Returns, Return Persistence, Stock Exchange of ThailandAbstract

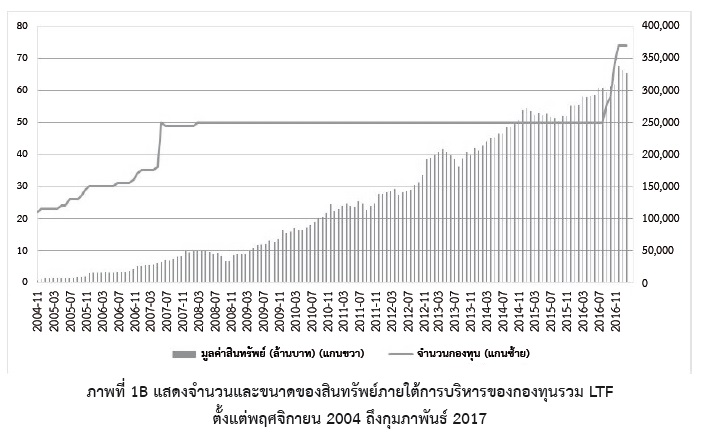

This study examines returns and their persistence of 48 active Long-Term Equity Funds (LTFs) and 26 active Thai equity Retirement Mutual Funds (RMFs) during 2002-2017. The average net returns (including dividends and after expense deduction) of both LTF and RMF funds under study are lower than the SET (Stock Exchange of Thailand) average total return by about 2% -3% per year. The average Alphas from Capital Asset Pricing Model (CAPM) of LTF and RMF funds are -1.28% per year and -0.34% per year, respectively. About 12 LTF funds out of the total of 48 LTF funds have positive Alphas, but no LTF fund has a statistically significant, positive Alpha. There are 10 RMF funds with positive Alphas from a total of 26 RMF funds, with 1 RMF fund with a statistically significant, positive Alpha. This study also shows that the returns of both LTF and RMF funds have no clear persistence. This is because the strategy of buying the top-performance funds during the last three years can beat the market over the next three years for some certain periods. Finally some of the top-5 or top-20 funds during the past three years are able to maintain their top ranking over the next three years. Therefore, the good performance of funds in the past is not a reliable indicator of their future good performance.

References

สรศาสตร์ สุขเจริญสิน และ ปริยดา สุขเจริญสิน. 2556. ความสม่ำเสมอของผลการดำเนินงานของกองทุนรวมตราสารทุนในประเทศไทย. วารสารเศรษฐศาสตร์ปริทรรศน์ ปีที่ 7 ฉบับที่ 2 หน้า 101-132.

ณัฐวุฒิ เจนวิทยาโรจน์. 2560. ผลการดำเนินงานและความต่อเนื่องของผลการดำเนินงานของกองทุนรวมตราสารทุนในประเทศไทยในช่วง 1995-2014. จุฬาลงกรณ์ธุรกิจปริทัศน์ ปีที่ 39 ฉบับ 152 หน้า 57-89.

Allen, D.E. and M.L. Tan. (1999). “A Test of the Persistence in the Performance of UK Managed Funds.” Journal of Business Finance and Accounting 25:559-593.

Blake, D. and Timmerman, A. (1998). ‘Mutual Fund Performance: Evidence for the UK’, European Finance Review. Vol. 2, No. 1, pp. 57-77.

Carhart, M.M. (1997). “On Persistence in Mutual Fund Performance.” Journal of Finance 52:57-82.

Elton, E.J., M.J. Gruber, S. Das, and M. Hlavka. (1993). “Efficiency with Costly Information: A Reinterpretation of Evidence from Managed Portfolios.” Review of Financial Studies 6:1-21.

Fletcher, J. and D. Forbes. (2002). “An Exploration of the Persistence of UK Unit Trusts Performance.” Journal of Empirical Finance 9:475-493.

Ippolito, R.A. (1989).“Efficiency with Costly Information: A Study of Mutual Fund Performance 1965-1984.” Quarterly Journal of Economics 104:1:1-23.

Malkiel, B. G., (1995). Return from investing in equity mutual funds 1971 to 1991, Journal of Finance 50, 549-572.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 NIDA Business School, National Institute of Development Administration

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.