The study of the return behavior of the big-cap stocks on the Stock Exchange of Thailand: Evidence from pre-, during, and post-Covid-19

Keywords:

SET 50 Index, the Stock Exchange of Thailand, Weak-Form Market Efficiency, Covid-19, Time-Series PropertiesAbstract

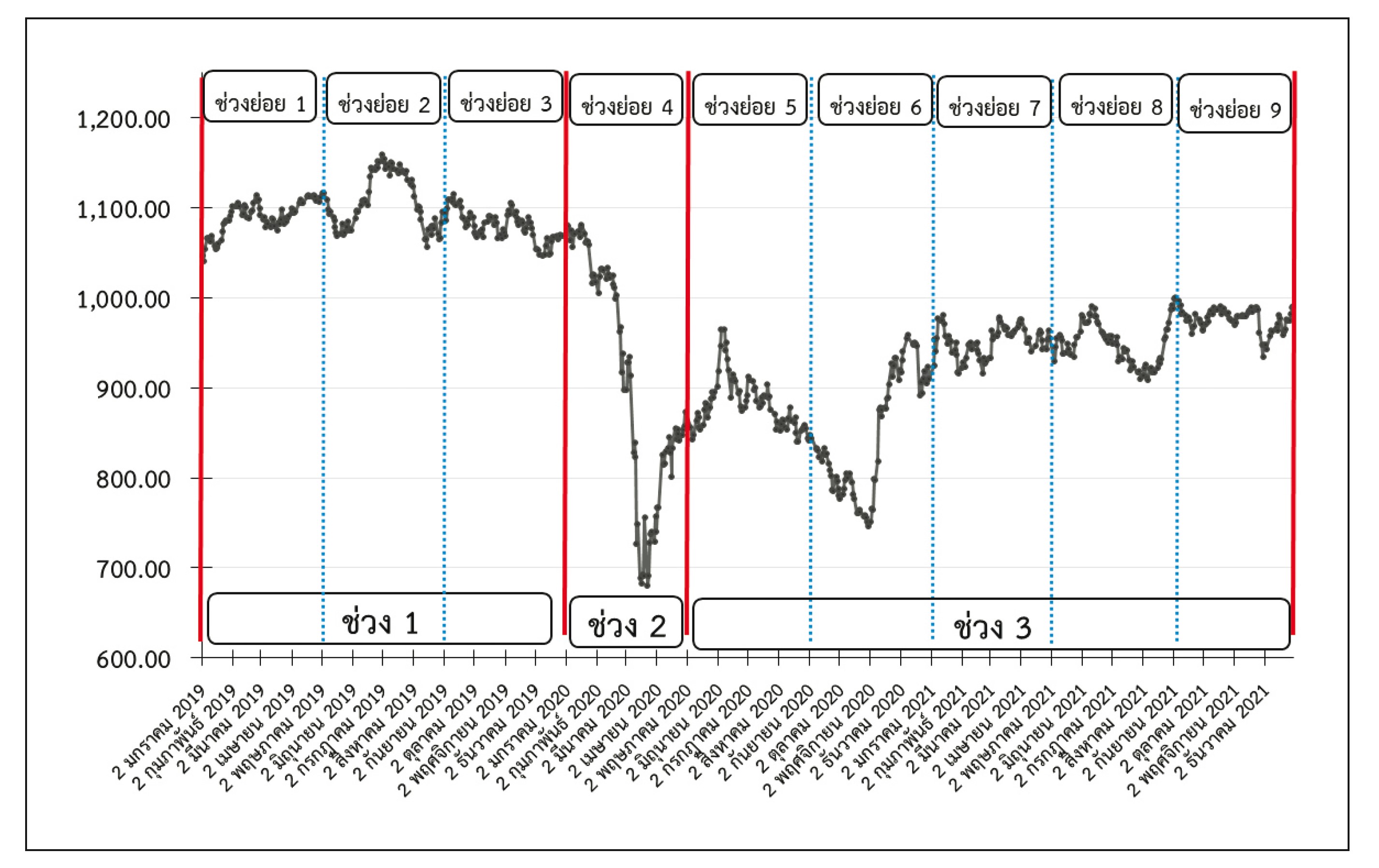

This research examines the time-series properties and weak-form efficiency of the big-cap stocks in the SET 50 index of the Stock Exchange of Thailand in pre- and during-Covid-19 periods. The results show that during the first four months of year 2020, considered the initial phase of the Covid-19 pandemic, where numerous Covid-related news and comments cause panic and negative sentiment among investors, the time-series properties of the big-cap stocks in the SET 50 index has changed dramatically, compared with those in the pre-Covid-19 or normal period. That is, during the first four months of year 2020, the SET 50 index experienced negative returns, high volatilities, and more frequent extremely-negative returns than normal. In addition, there exists weak-form market inefficiency in the big-cap stocks in the SET 50 index during the first four months of year 2020, implying that stock prices do not reflect all available weak-form information, possibly caused by the investor’s overreaction to pandemic-related news. However, after the first four months of year 2020, the time-series properties and the weak-form efficiency of the SET 50 index are back to normal, i.e., similar to those in the pre-Covid-19 period.

References

Al-Awadhi, A. M., Alsaifi, K., Al-Awadhi, A., & Alhammadi, S. (2020). Death and contagious infectious diseases: Impact of the COVID-19 virus on stock market returns. Journal of Behavioral and Experimental Finance, 27, 100326. https://doi.org/10.1016/j.jbef.2020.100326

Chundakkadan, R., & Nedumparambil, E. (2022). In search of COVID-19 and stock market behavior. Global Finance Journal, 54, 100639. https://doi.org/10.1016/j.gfj.2021.100639

Fama, E. F. (1970). Efficient capital markets: A review of theory and empirical work. Journal of Finance, 25(2), 383-417. https://doi.org/10.2307/2325486

Haroon, O., & Rizvi, S. A. R. (2020). COVID-19: Media coverage and financial markets behavior - A sectoral inquiry. Journal of Behavioral and Experimental Finance, 27, 100343. https://doi.org/10.1016/j.jbef.2020.100343

Jenwittayaroje, N. (2021). Testing weak-form market efficiency in the Stock Exchange of Thailand. Global Business and Economic Review, 24(3), 211-224. https://doi.org/10.1504/GBER.2021.114657

Jenwittayaroje, N. (2020). Return behavior of the individual stocks: an empirical test on the weak form efficiency of SET50 and SET100 stocks on the Stock Exchange of Thailand. Kasetsart Applied Business Journal, 14(20), 78-96.

Khanthavit, A. (2016). The Fast and Slow Speed of Convergence to Market Efficiency A Note for Large and Small Stocks on the Stock Exchange of Thailand. Social Science Asia, 2(2), 1-6.

Khanthavit, A., Boonyaprapatsara, N., & Saechung, A. (2012). Evolving Market Efficiency of Thailand's Stock Market. Applied Economics Journal, 19(1), 46-67.

Ozkan, O. (2021). Impact of COVID-19 on stock market efficiency: evidence from developed countries. Research in International Business and Finance, 58, 101445. https://doi.org/10.1016/j.ribaf.2021.101445

Tetlock, P. C. (2007). Giving content to investor sentiment: the role of media in the stock market. Journal of Finance, 62(3), 1139-1168. https://doi.org/10.1111/j.1540-6261.2007.01232.x

Topcu, M., & Gulal, O. S. (2020). The impact of COVID-19 on emerging stock markets. Finance Research Letters, 36, 101691. https://doi.org/10.1016/j.frl.2020.101691

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2022 NIDA Business School, National Institute of Development Administration.

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.