Earnings, Cash Flow and Accrual Characteristics of the SET 50 Companies During the COVID-19 Pandemic

Keywords:

Earnings Persistence, Accruals, Cash Flows Predictability, The Pandemic COVID-19Abstract

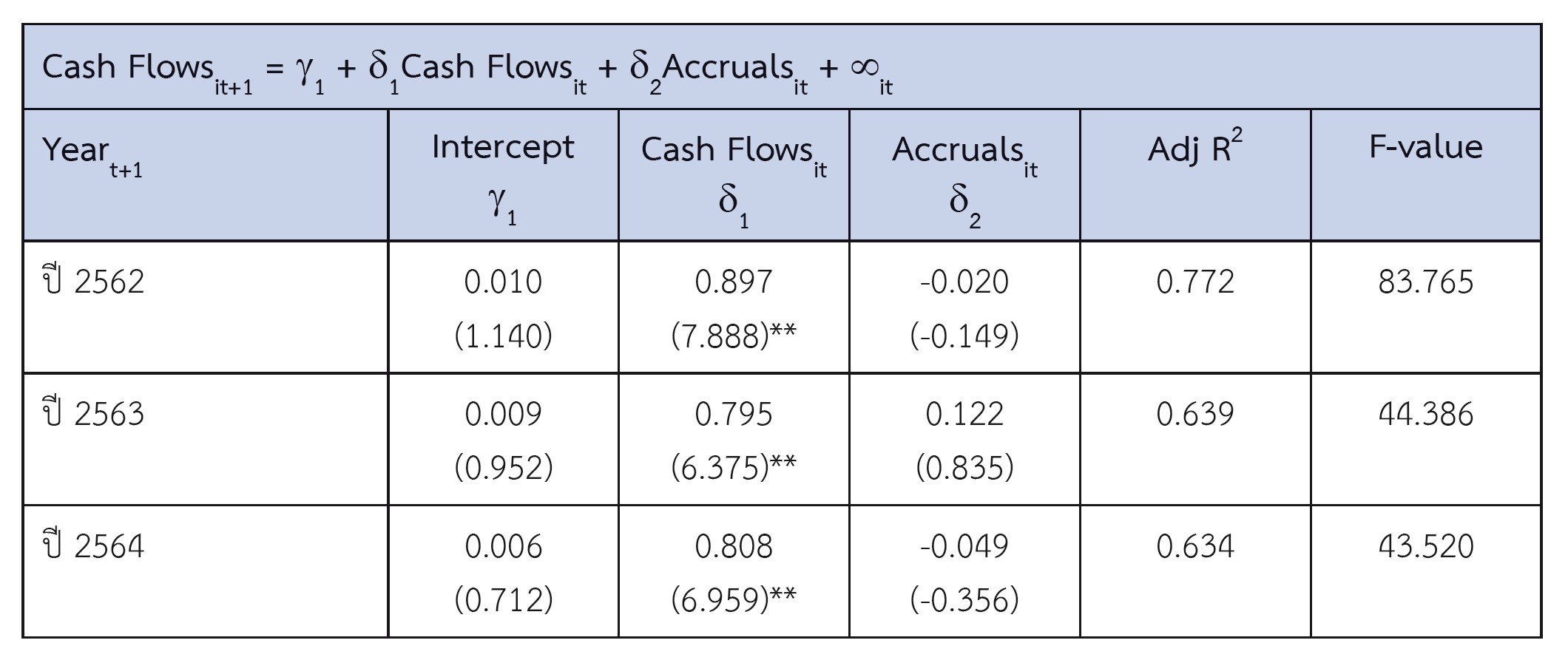

This study examines earnings, cash flow and accrual characteristics of the SET 50 companies during the COVID-19 pandemic. The study examines earnings persistence and one-year ahead cash flow predictability of these accounting information during the year 2018-2021, covering the COVID-19 Pandemic. The results show that in the year 2020 earnings has relative low persistence when compared with the earnings from the prior years, and accruals has lowest persistence in three years, and has lower persistence than cash flows. Also, earnings 2020 has lowest explanatory power in one-year ahead cash flows. During three-year analysis, cash flows is dominant information in explaining future cash flows, while accruals do not have incremental explanatory power beyond cash flows in explaining future cash flows. The evidences reveal the usefulness of earnings, cash flows, and accruals in predicting the companies’ performance during the unusual situation.

References

Abdelghany, K. E. (2005). Measuring the Quality of Earnings. Managerial Auditing Journal, 20(9), 1001-1015. https://doi.org/10.1108/02686900510625334

Barth, Mary E., Donald P. Cram, and Karen K. Nelson. (2001). Accruals and the Prediction of Future Cash Flows. The Accounting Review, 76(1), 27-58. https://doi.org/10.2308/accr.2001.76.1.27

Buasai, Nattanan. (2015). The Value Relevance of Accounting-Based Performance Measures: Evidence from Thailand. An Independent Study; Thammasat University.

Dechow, P.M. (1994). Accounting Earnings and Cash Flows as Measures of Firm Performance: The Role of Accounting Accruals. Journal of Accounting and Economics, 18(1), 3-42. https://doi.org/10.1016/0165-4101(94)90016-7

Dechow, P.M., S.P. Kothari, and Ross L. Watts. (1998). The Relation Between Earnings and Cash Flows. Journal of Accounting and Economics, 25, 133-168. https://doi.org/10.1016/S0165-4101(98)00020-2

Federation of Accounting Profession (2020). Examples for Temporary Exemption Guidance to Relieve the Impact from the COVID-19 Pandemic. Bangkok. Federation of Accounting Professions.

Federation of Accounting Professions (2020). Temporary Exemption Guidance to Relieve the Impact from the COVID-19 Pandemic. Bangkok. Federation of Accounting Professions.

Narktabee, Kanogporn. (2000). The Implication of Accounting Information in The Thai Capital Market. Dissertation; University of Arkansas.

Narktabtee, Kanogporn, Thomas A Carnes, and Ervin L. Black. (2002). The Effects of Earnings and Cash Flow Permanence on their Incremental Information Content in Thailand. Asia-Pacific Journal of Accounting & Economics, 9(1), 1-16. https://doi.org/10.1080/16081625.2002.10510597

Panyuchuensakunsuk, Patcharasuda, Pongprot Chatraphorn, and Wilasini Wongkaew. (2012). The Value Relevance of Net Income Components of Listed Firms in the Stock Exchange of Thailand in the Last Decade. Chulalongkorn Business Review, 34(134), 46-81.

Sajjawat Junhom, Sillapaporn Srijunpetch (2012). Earnings Quality of Thai Family-owned and managed Firms. Journal of Accounting Profession, 8(21), (78-88).

Sloan, R.G. (1996). Do Stock Prices Fully Reflect Information in Accruals and Cash Flows about Future Earnings? The Accounting Review, 71(3), 289-315.

The Stock Exchange of Thailand. (2020). SET50 & SET100 INDEX CONSTITUENTS. Retrieved January 15, 2021, from Website https://www.set.or.th/th/market/files/constituents/SET50_100_H2_2020_revised.pdf

Vichitsarawong, Thanyalak. (2011). The Value Relevance of Earnings and Cash Flows: Evidence from Thailand. Journal of Accounting Profession. 7(19). 39-53.

Vivattanachang, Dollada and Somchai Supattarakul (2013). The Earnings Persistence and the Market Pricing of Earnings and their Cash Flow and Accrual Components of Thai Firms. Journal of Accounting Profession, 9(25), 63-79.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2022 NIDA Business School, National Institute of Development Administration

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.