The performance of Thai equity mutual funds during the Covid-19 crisis

Keywords:

Thai equity mutual funds, Covid-19 crisis, Active investing, Alpha, Economic recessionAbstract

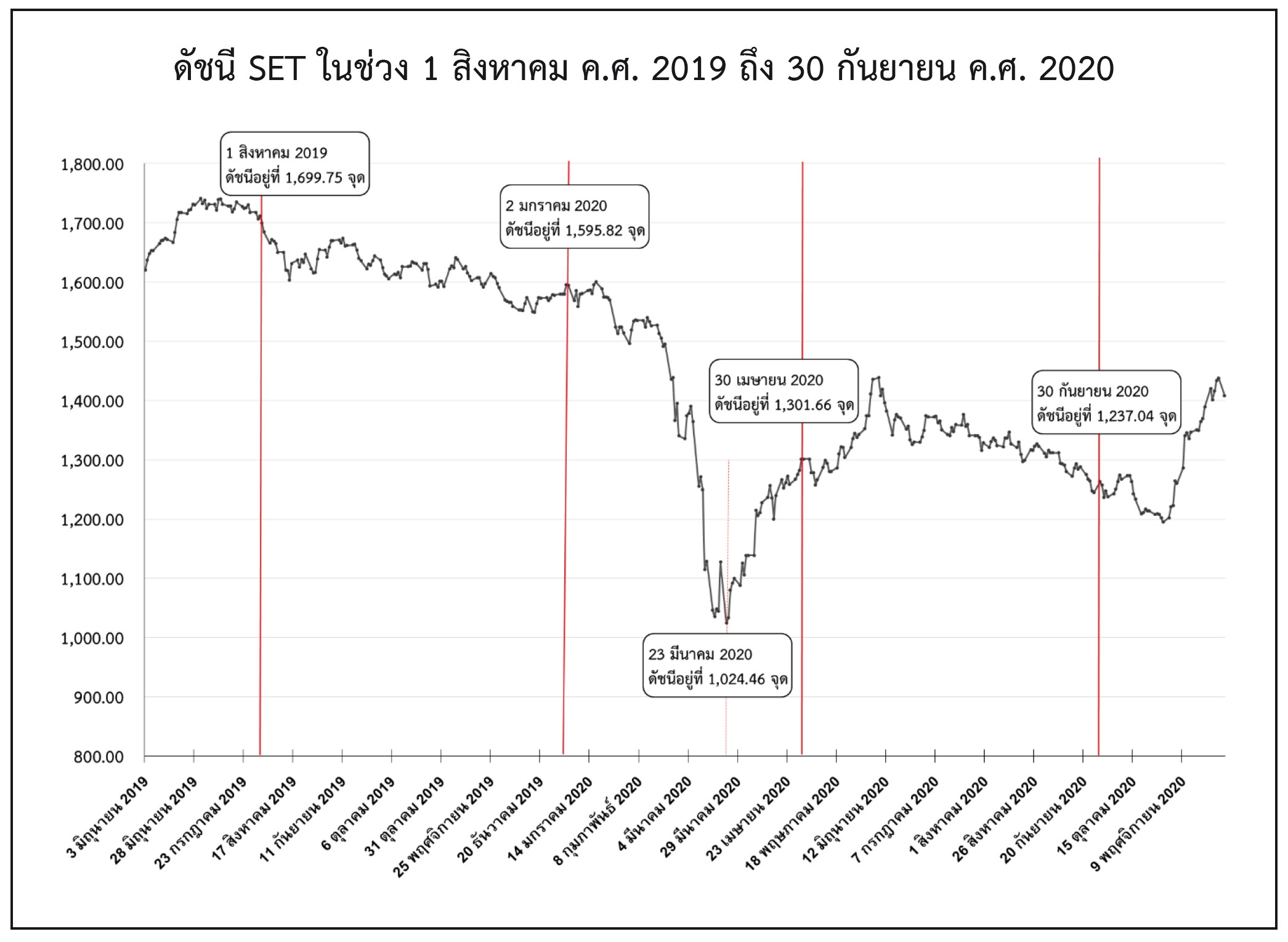

This research examines the performance of 274 actively-managed Thai equity funds during the period of Covid-19 crisis. The results show that during the Covid crisis period, where stock prices abruptly plummeted and were highly volatile, and economic conditions became worse from 2 January 2020 to 30 April 2020, all those funds under study earned an average return of 3.86% per year below the market return, and an alpha from CAPM (Capital Asset Pricing Model) of -6.87% per year. Our results are not consistent with the empirical evidence in international markets that, although equity funds underperformed unconditionally, they tend to outperform during the period of economic recessions. The results are also in contrast to the Glode (2011)’s model prediction that equity funds tend to outperform during economic recessions as a hedge for investors.

References

Banegas, A., Gillen, B., Timmermann, A., & Wermers, R. (2013). The Cross Section of Conditional Mutual Fund Performance in European Stock Markets. Journal of Financial Economics, 108(3), 699-726. https://doi.org/10.1016/j.jfineco.2013.01.008

Carhart, M. M. (1997). On Persistence in Mutual Fund Performance. The Journal of Finance, 52(1), 57-82. https://doi.org/10.1111/j.1540-6261.1997.tb03808.x

Fama, E. F., & French, K. R. (2010). Luck Versus Skill in the Cross-Section of Mutual Fund Returns. The Journal of Finance, 65(5), 1915-1947, https://doi.org/10.1111/j.1540-6261.2010.01598.x

Glode, V. (2011). Why Mutual Funds Underperform? Journal of Financial Economics, 99(3), 546-559. https://doi.org/10.1016/j.jfineco.2010.10.008

Jensen, M. (1968). The Performance of Mutual Fund in the Period 1945-1964. Journal of Finance, 23(2), 389-416. https://doi.org/10.1111/j.1540-6261.1968.tb00815.x

Jenwittayaroje, N. (2017). The Performance and Its Persistence of Thailand Equity Mutual Funds from 1995-2014. Chulalongkorn Business Review, Vol. 39 Issue 152, page 57-89.

Jenwittayaroje, N. (2018). Returns and Their Persistence from Investing in Active Long-Term Equity Funds and Active Equity Retirement Funds. NIDA Business Journal, Vol. 22, page 61-86.

Kosowski, R. (2011). Do Mutual Funds Perform When It Matters Most to Investors? US Mutual Fund Performance and Risk in Recessions and Expansions. Quarterly Journal of Finance, 1(3), 607-664. https://doi.org/10.1142/S2010139211000146

Malkiel, B. G. (1995). Returns from Investing in Equity Mutual Funds 1971 to 1991. The Journal of Finance, 50(2), 549-572. https://doi.org/10.1111/j.1540-6261.1995.tb04795.x

Moskowitz, T. J. (2000). Mutual Fund Performance: An Empirical Decomposition into Stock-Picking Talent, Style, Transactions Costs, and Expenses: Discussion. Journal of Finance 55, 1695-1703. https://doi.org/10.1111/0022-1082.00264

Pástor, L., and M. B. Vorsatz. (2020). Mutual Fund Performance and Flows During the COVID-19 Crisis. The Review of Asset Pricing Studies, 10(4), 791-833. https://doi.org/10.1093/rapstu/raaa015

Wermers, R. (2000). Mutual Fund Performance: An Empirical Decomposition into Stock-Picking Talent, Style, Transactions Costs, and Expenses. The Journal of Finance, 55(4), 1655-1695. https://doi.org/10.1111/0022-1082.00263

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 NIDA Business School, National Institute of Development Administration

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.