The Impact of Factors Related to the COVID-19 on Each Industry in Thai Equity Markets

Keywords:

COVID-19, equity market, liquidity, volatilityAbstract

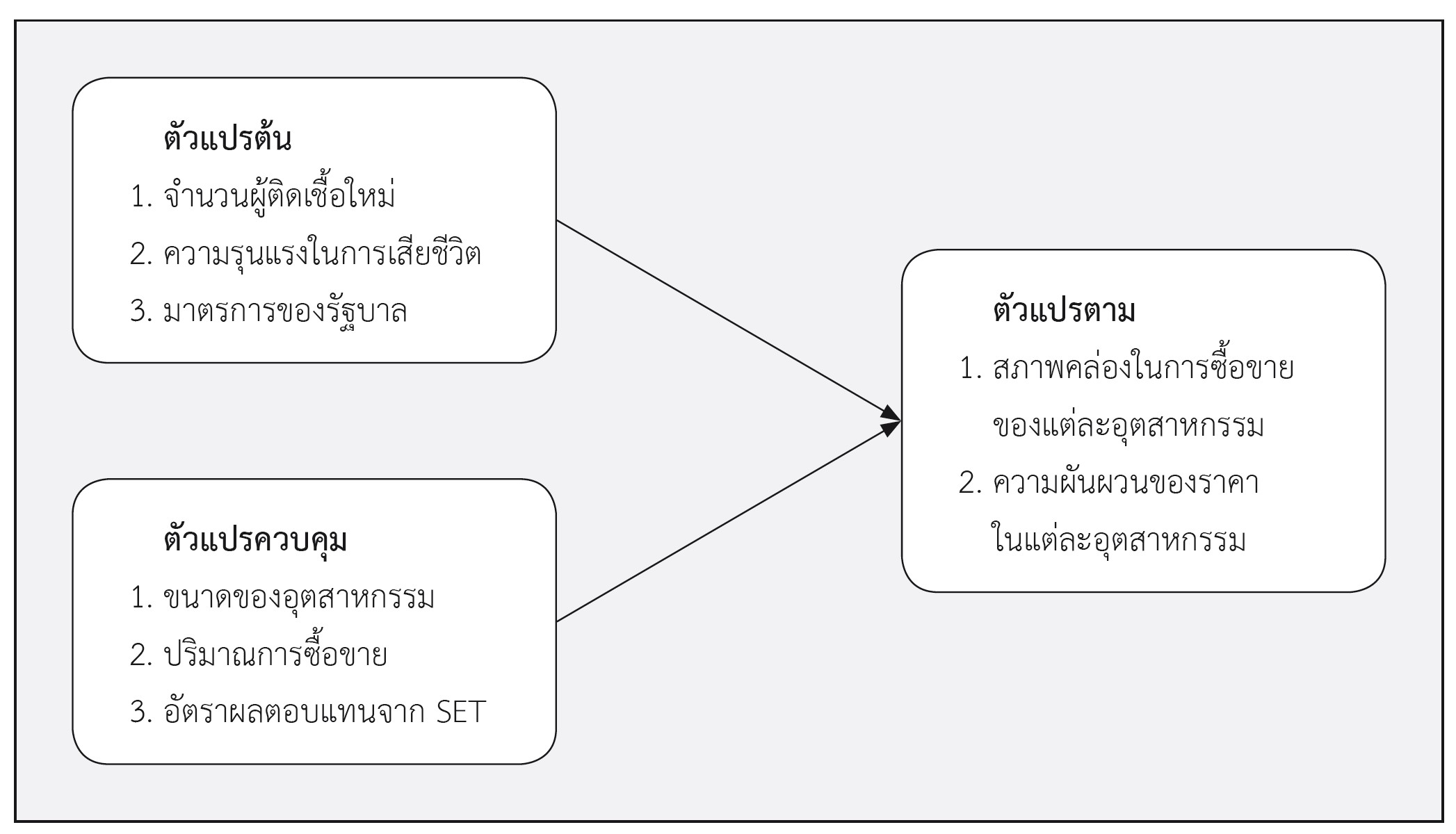

The purpose of this study is to study the factors affecting liquidity and volatility of each industry’s stocks in Thai equity markets during the COVID-19 pandemic. The industry’s liquidity is measured by turnover ratio and Amihud’s illiquidity while the industry’s volatility is measured by Garman & Klass and range-based volatility. The study’s statistical tests are based on regression models. The data of stock market information is obtained from SETSMART, the data of confirmed cases and deaths in Thailand are from the Department of Disease Control, and the Stringency index is obtained from Oxford COVID-19 Government Response Tracker (OxCGRT). The results suggest that the increases in cases, deaths, and stringency index due to COVID-19 bring about an increase in the liquidity of most industries. However, the increases in cases, deaths, and stringency index due to COVID-19 impact each industry differently, depending on the industry’s ability to respond to or take advantages of the pandemic.

References

Al-Awadhi, A. M., Alsaifi, K., Al-Awadhi, A., & Alhammadi, S. (2020). Death and contagious infectious diseases: Impact of the COVID-19 virus on stock market returns. Journal of behavioral and experimental finance, 27, 100326. https://doi.org/10.1016/j.jbef.2020.100326

Albulescu, C. (2020). Coronavirus and financial volatility: 40 days of fasting and fear. arXiv preprint arXiv:2003.04005. https://doi.org/10.2139/ssrn.3550630

Amihud, Y. (2002). Illiquidity and stock returns: cross-section and time-series effects. Journal of financial markets, 5(1), 31-56. https://doi.org/10.1016/S1386-4181(01)00024-6

Baig, A. S., Butt, H. A., Haroon, O., & Rizvi, S. A. R. (2021). Deaths, panic, lockdowns and US equity markets: The case of COVID-19 pandemic. Finance research letters, 38, 101701. https://doi.org/10.1016/j.frl.2020.101701

Fama, E. F. (1970). Efficient market hypothesis: A review of theory and empirical work. Journal of Finance, 25(2), 28-30. https://doi.org/10.2307/2325486

Garman, M. B., & Klass, M. J. (1980). On the estimation of security price volatilities from historical data. Journal of business, 67-78. https://doi.org/10.1086/296072

Glosten, L. R., & Milgrom, P. R. (1985). Bid, ask and transaction prices in a specialist market with heterogeneously informed traders. Journal of financial economics, 14(1), 71-100. https://doi.org/10.1016/0304-405X(85)90044-3

Government Response Tracker (OxCGRT). COVID-19 Government Response Tracker. สืบค้นจากhttps://www.bsg.ox.ac.uk/research/research-projects/covid-19-government-response-tracker

Hasbrouck, J. (1988). Trades, quotes, inventories, and information. Journal of financial economics, 22(2), 229-252. https://doi.org/10.1016/0304-405X(88)90070-0

Klibanoff, P., Lamont, O., & Wizman, T. A. (1998). Investor reaction to salient news in closed‐end country funds. The Journal of Finance, 53(2), 673-699. https://doi.org/10.1111/0022-1082.265570

Narayan, P. K., Phan, D. H. B., & Liu, G. (2021). COVID-19 lockdowns, stimulus packages, travel bans, and stock returns. Finance research letters, 38, 101732. https://doi.org/10.1016/j.frl.2020.101732

Shefrin, H., & Statman, M. (1985). The disposition to sell winners too early and ride losers too long: Theory and evidence. The Journal of finance, 40(3), 777-790. https://doi.org/10.1111/j.1540-6261.1985.tb05002.x

Su, Z., Fang, T., & Yin, L. (2017). The role of news-based implied volatility among US financial markets. Economics Letters, 157, 24-27. https://doi.org/10.1016/j.econlet.2017.05.028

Tetlock, P. C. (2007). Giving content to investor sentiment: The role of media in the stock market. The Journal of finance, 62(3), 1139-1168. https://doi.org/10.1111/j.1540-6261.2007.01232.x

Zaremba, A., Kizys, R., Aharon, D. Y., & Demir, E. (2020). Infected markets: Novel coronavirus, government interventions, and stock return volatility around the globe. Finance Research Letters, 35, 101597. https://doi.org/10.1016/j.frl.2020.101597

Zhang, D., Hu, M., & Ji, Q. (2020). Financial markets under the global pandemic of COVID-19. Finance research letters, 36, 101528. https://doi.org/10.1016/j.frl.2020.101528

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 https://creativecommons.org/licenses/by-nc-nd/4.0/

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.