Price Discovery Function of Gold Futures Market in China

Keywords:

Unit Root, Cointegration, Vector Error Correction, Granger Causality, Impulse Response FunctionsAbstract

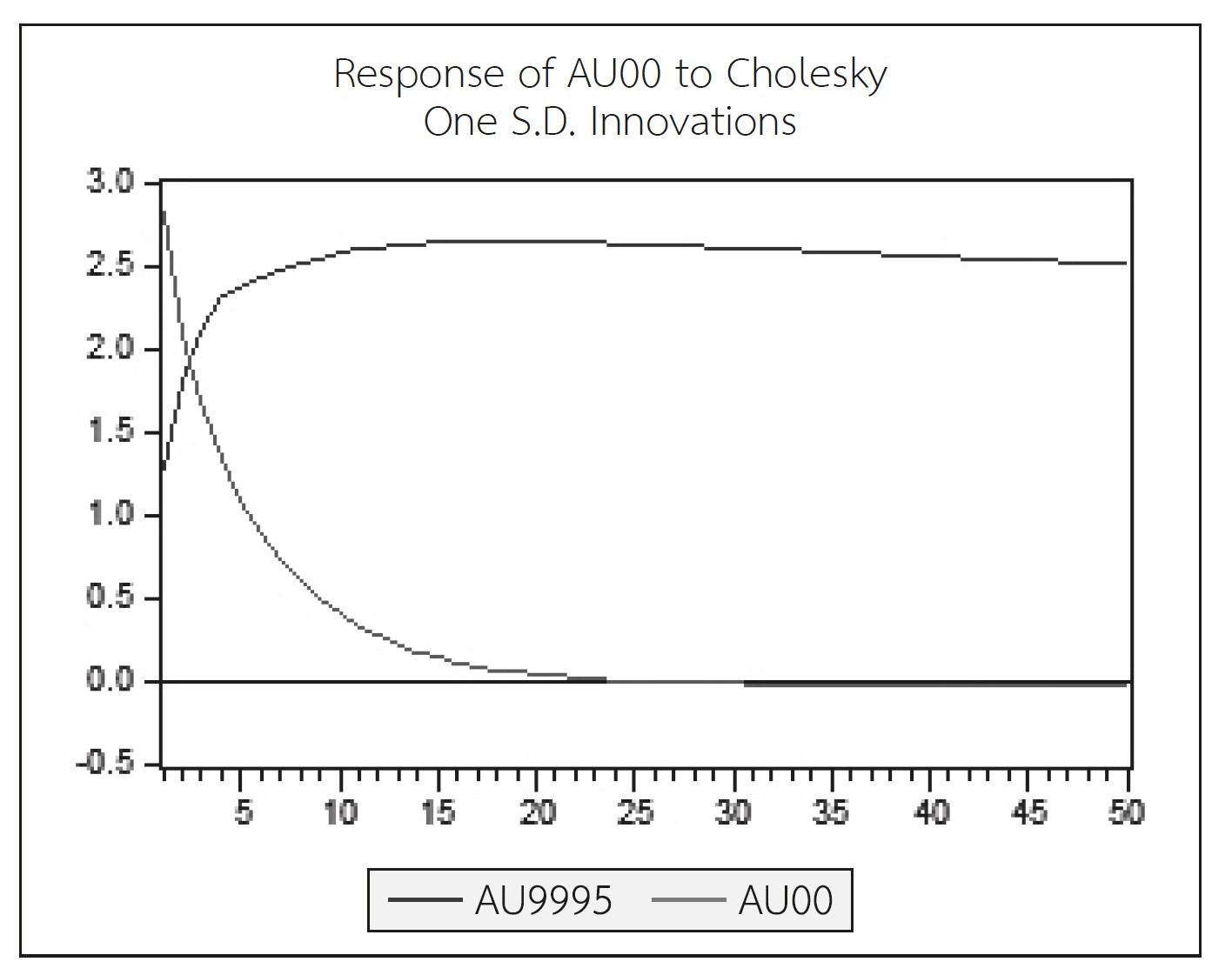

The purpose of this paper is to explore whether the Chinese gold futures market has the price discovery function. The Unit Root test, Cointegration test, Vector Error Correction Model (VECM) test, Granger Causality test and Impulse Response Function are used to examine the lead-lag relationship between gold spot price and gold futures price. The paper selects data for the period starting January 9, 2008 to January 9, 2018. The daily spot price is the daily closing price of Au99.95 from the Shanghai Gold Exchange and the daily gold futures price used in this research is the daily settlement price of the gold futures continuous contract. The Unit Root test shows that gold spot and futures prices are stationary at first order difference. Cointegration test reports a long-term equilibrium relationship between gold spot prices and gold futures prices. The short-term dynamic relationship between the gold futures price and the spot price is proved by the VECM test. The results of the Granger Causality test and the Impulse Response Function confirm that the gold spot price leads the gold futures price, but not vice versa. The conclusion demonstrates that China's gold futures market does not have price discovery function.

References

Campbell, B., & Hendry. S. (2007). Price Discovery in Canadian and U.S. 10-Year Government Bond Markets. Bank of Canada, Working Paper, 07-43. https://doi.org/10.2139/ssrn.1082782

Chan, K. (1992). A further analysis of the lead-lag relationship between the cash market and stock index futures market. The Review of Financial Studies, 5(1), 123-152. https://doi.org/10.1093/rfs/5.1.123

Cornell, B., & French, K. R. (1983). Taxes and the pricing of stock index futures. The Journal of Finance, 3, 675-694. https://doi.org/10.1111/j.1540-6261.1983.tb02496.x

Engle, R.F., & Granger, C.W. (1987). Cointegration and error correction: Representation, estimation and testing. Econometrica, 55(2), 251-276. https://doi.org/10.2307/1913236

Ersoy, E., & Çıtak, L. (2015). Intraday Lead-Lag Relationship between Stock Index and Stock Index Futures Markets: Evidence from Turkey. Business and Economics Research Journal, 6(3), 1-18.

Fama, E.F. & French, K.R. (1988). Business cycles and the behavior of metals prices. The Journal of Finance. 43(5), 1075-1093. https://doi.org/10.1111/j.1540-6261.1988.tb03957.x

Fama, E.F. (1970). Efficient capital markets: A review of theory and empirical work. The Journal of Finance, 25(2), 383-417. https://doi.org/10.2307/2325486

Feng, W., Liu, S., Lai, M., & Deng, X. (2007). Empirical research on price discovery efficiency in electricity futures market. Power Engineering Society General Meeting, 1-6. https://doi.org/10.1109/PES.2007.385923

Floros, C. (2009). Price Discovery in the South African Stock Index Futures Market. International Research Journal of Finance and Economics, 34, 148-159.

Goodwin, B.K., & Schroeder, T.C. (1991). Cointegration tests and spatial price linkages in regional cattle markets. American Journal of Agricultural Economics, 73(2), 452-464. https://doi.org/10.2307/1242730

Hoffman, G. W. (1933). Future Trading upon Organized Commodity Markets in the United States. Journal of the Royal Statistical Society, 96(2), 697-699. https://doi.org/10.2307/2341919

Hull, J. C. (2014). Options, Futures, and Other Derivatives. Boston: Pearson. 6th edition.

Investorwords (2018). Futures Price. Retrieved May 11, 2018, from http://www.investorwords.com/2138/futures_price.html

Johansen, S. (1988). Statistical analysis of cointegration vectors. Journal of Economic Dynamics and Control, 12, 231-254. https://doi.org/10.1016/0165-1889(88)90041-3

Johansen, S., & Juselius, K. (1990). Maximum likelihood estimation and inference on cointegration-with applications to the demand for money. Econometrica, 52(2), 169-210. https://doi.org/10.1111/j.1468-0084.1990.mp52002003.x

Johansen, S. (1991). Estimation and Hypothesis Testing of Cointegration Vectors in Gaussian Vector Autoregressive Models. Econometrica, 59(6), 1551-1580. https://doi.org/10.2307/2938278

Kaldor, N. (1939). Speculation and economic stability. Review of Economic Studies, 7 (1), 1-27. https://doi.org/10.2307/2967593

Mahalik, M. K., Acharya, D., & Babu, M. S. (2014). Price discovery and volatility spillovers in futures and spot commodity markets: Some Indian evidence". Journal of Advances in Management Research, 11(2), 211-226. https://doi.org/10.1108/JAMR-09-2012-0039

Min, J.H., & Najand, M. (1999). A further investigation of the lead-lag relationship between the spot market and stock index futures: Early evidence from Korea. Journal of Futures Markets, 19(2), 217-232. https://doi.org/10.1002/(SICI)1096-9934(199904)19:2<217::AID-FUT5>3.0.CO;2-8

Muth, J. F. (1961). Rational expectations and the theory of price movements. Econometrica, 29(23), 315-335. https://doi.org/10.2307/1909635

Nasdaq (2018). Spot Price. Retrieved May 11, 2018, from https://www.nasdaq.com/investing/glossary/s/spot-price

Oellermann, C. M., Brorsen, B. W., & Farris, P. L. (1989). Price discovery for feeder cattle. Journal of Futures Markets, 9 (2), 113-121. https://doi.org/10.1002/fut.3990090204

Pradhan, K.C. (2017). Price Movements in Futures and Spot Markets: Evidence from the S&P CNX Nifty Index. Review of Business and Economics Studies, 5(1), 32-41.

Qin, R., & Heo, J. (2017). The Lead-Lag Relationship between Volatility Index Futures and Spot in the Korean Stock Market. Journal of International Trade & Commerce, 13(4), 139-159. https://doi.org/10.16980/jitc.13.4.201708.139

Schroeder, T.C., & Ward, C.E. (2000). Price Discovery Issues and Trends in Cattle and Hog Markets. Agricultural Economics Association, 9.

Sepanek, E. (July 12, 2017). Understanding how gold prices are determined. Scottsdale Bullion & Coin. Retrieved from https://www.sbcgold.com/blog/how-gold-prices-are-determined/

Shanghai Gold Exchange of Thailand (2018). Au99.95. Retrieved May 11, 2018, from http://www.en.sge.com.cn/eng_trading_ProductsIntroduce_Physicaldetails?pro_id=943328057423458304

Shihabudheen, M.T., & Padhi, P. (2010). Price discovery and volatility spillover effect in the Indian commodity market. Indian Journal of Agricultural Economics, 65(1), 101-117.

Shu, J., & Zhang, J.E. (2012). Causality in the VIX futures market. Journal of Futures Markets, 32(1), 24-46. https://doi.org/10.1002/fut.20506

Silvapulle, P., & Moosa, I.A. (1999). The relationship between spot and futures prices: Evidence from the crude oil market. The Journal of Futures Markets, 19(2), 175-193. https://doi.org/10.1002/(SICI)1096-9934(199904)19:2<175::AID-FUT3>3.0.CO;2-H

Turkington, J., & Walsh, D. (1999). Price Discovery and Causality in the Australian Share Price Index Futures Market. Australian Journal of Management, 24(2), 97-113. https://doi.org/10.1177/031289629902400201

Wang, H., Jiang, F., & Wu, J. (2001). An empirical analysis on the casual relationship between copper future and cash copper. Forecasting, 20(1), 75-77.

Working, N. (1933). Price relations between July and September wheat futures at Chicago since 1885. Wheat Studies, 9(6), 187- 240.

Working, H. (1948). Theory of the Inverse Carrying Charge in Futures Markets. American Journal of Agricultural Economics, 30(2), 1-28. https://doi.org/10.2307/1232678

Yang, J., Yang, Z., & Zhou, Y. (2012). Intraday price discovery and volatility transmission in stock index and stock index future markets: Evidence from China. The Journal of Futures Markets, 32(2), 99-121. https://doi.org/10.1002/fut.20514

Zhong, M., Darrat, A., & Otero, R. (2004). Price discovery and volatility spillovers in index futures markets: Some evidence from Mexico. SSRN Electronic Journal, 28(12), 3037-3054. https://doi.org/10.1016/j.jbankfin.2004.05.001

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 https://creativecommons.org/licenses/by-nc-nd/4.0/

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.