The Key Audit Matter (KAM) practices: the review of first year experience in Thailand

Keywords:

Key audit matter, auditor’s report, information content , format presentation , content analysis, ThailandAbstract

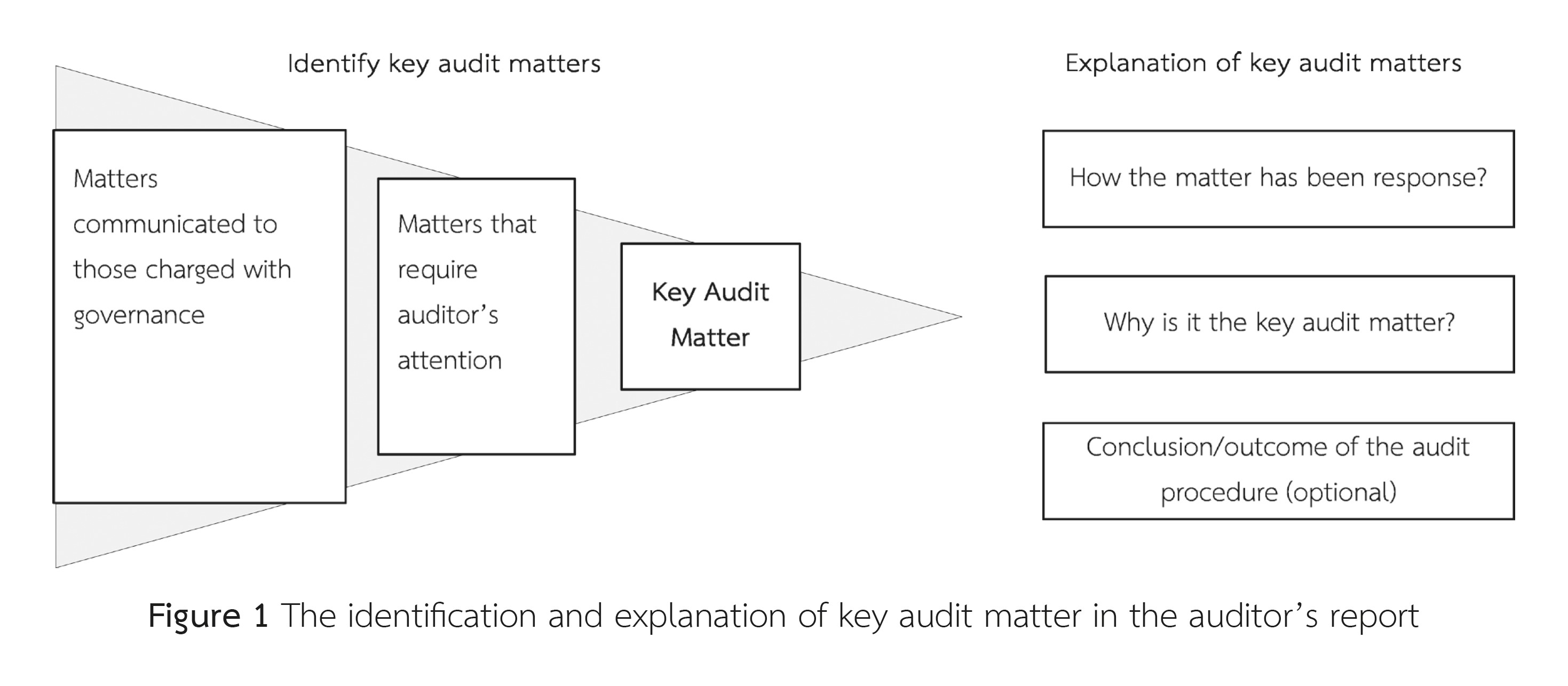

In response to concerns regarding the informativeness of the auditor’s report, audit standard setters around the world have developed several changes to the current pass/fail audit reporting model. One of the most significant changes is the inclusion of Key Audit Matter (KAM) in the auditor’s report. This new auditing standard is now effective in many countries, Thailand being one of them. The objective of this paper is to explore the extent of KAM analysis and its various elements, and the contents that are being disclosed for the first time in Thailand. The study reported that the auditors utilize KAM as communication channel to convey additional information in the auditor’s report. The format and content of KAM vary across firms. Many audit firms have developed different approaches to the reporting of the KAM, for example, reporting audit findings, presentation of KAM, and the length of KAM. The results of this study should provide preliminary insights about the implementation of these changes to both standard setters and users of financial statement.

References

Asare, S. K., & Wright, A. M. (2012). Investors', auditors', and lenders' understanding of the message conveyed by the standard audit report on the financial statements. Accounting Horizons, 26(2), 193-217.

Bank of Thailand. (2016). Retrieved from https://www.bot.or.th/Thai/FIPCS/Documents/FPG/2559/EngPDF/25590128.pdf.

Cotter, J., & Zimmer, I. (2003). Disclosure versus recognition: The case of asset revaluations. Asia-Pacific journal of accounting & economics, 10(1), 81-99.

Dilla, W. N., Janvrin, D. J., & Jeffrey, C. (2012). The impact of graphical displays of pro forma earnings information on professional and nonprofessional investors' earnings judgments. Behavioral Research in Accounting, 25(1), 37-60.

Dodd, P., Dopuch, N., Holthausen, R., &Leftwich, R. (1984). Qualified audit opinions and stock prices: Information content, announcement dates, and concurrent disclosures. Journal of Accounting and Economics, 6(1), 3-38.

Federation of Accounting Profession of Thailand. (2016). Auditor’s view on key audit matter. Retrieved from www.fap.or.th.

Financial Reporting Council (FRC). (2016, January). Extended auditor’s report: A further review of experience. Retrieved from https://www.frc.org.uk/Our-Work/Publications/Audit-and-Assurance-Team/Report-on-the-Second-Year-Experience-of-Extended-A.pdf.

Gray, G. L., Turner, J. L., Coram, P. J., & Mock, T. J. (2011). Perceptions and misperceptions regarding the unqualified auditor's report by financial statement preparers, users, and auditors. Accounting Horizons, 25(4), 659-684.

Healy, P. M., &Palepu, K. G. (2001). Information asymmetry, corporate disclosure, and the capital markets: A review of the empirical disclosure literature. Journal of accounting and economics, 31(1), 405-440.

Hogarth, R. M., &Einhorn, H. J. (1992). Order effects in belief updating: The belief-adjustment model. Cognitive psychology, 24(1), 1-55.

International Auditing and Assurance Standard Board (IAASB). (2011). Enhancing the value of auditor reporting: Exploring options for change. Retrieved from https://www.ifac.org/system/files/publications/exposure-drafts/CP_Auditor_Reporting-Final.pdf.

International Auditing and Assurance Standard Board (IAASB). (2015, January). New and revised auditor’s reporting standards and related conforming amendments. Retrieved from https://www.ifac.org/system/files/uploads/IAASB/Audit%20Reporting-At%20a%20Glance-final.pdf.

KPMG. (2015, July 15). Enhance auditor reporting: Provide insight and transparency. Retrieved from https://home.kpmg.com/content/dam/kpmg/pdf/2015/08/enhancing-auditor-reporting.pdf.

Koonce, L., & Mercer, M. (2005). Using psychology theories in archival financial accounting research. Journal of Accounting Literature, 24, 175-214.

Maines, L. A., & McDaniel, L. S. (2000). Effects of comprehensive-income characteristics on nonprofessional investors' judgments: The role of financial-statement presentation format. The accounting review, 75(2), 179-207.

Mock, T. J., Bédard, J., Coram, P. J., Davis, S. M., Espahbodi, R., & Warne, R. C. (2012). The audit reporting model: Current research synthesis and implications. Auditing: A Journal of Practice & Theory, 32(sp1), 323-351.

O'Reilly, D. M., Leitch, R. A., & Tuttle, B. (2006). An Experimental Test of the Interaction of the Insurance and Information‐Signaling Hypotheses in Auditing. Contemporary Accounting Research, 23(1), 267-289.

Public Company Accounting Oversight Board (PCAOB). (2016, May 11). Proposed auditing standard : The auditor’s report on an audit of financial statements when the auditor expresses an unqualified opinion. Retrieved from https://pcaobus.org/Rulemaking/Docket034/Release-2016-003-ARM.pdf.

Rennekamp, K. (2012). Processing fluency and investors’ reactions to disclosure readability. Journal of Accounting Research, 50(5), 1319-1354.

Tan, H. T., & Tan, S. K. (2009). Investors' Reactions to Management Disclosure Corrections: Does Presentation Format Matter?.Contemporary Accounting Research, 26(2), 605-626.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 https://creativecommons.org/licenses/by-nc-nd/4.0/

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.