The Relationship Between Investors’ Demand for Dividend and the Decision to Pay Dividend in the Future by The Firms in The Stock Exchange of Thailand

Keywords:

Investor expectations, Dividend, the Stock Exchange of ThailandAbstract

This study investigates the relationship between investors' demand for dividend and the decision to pay dividends in the future by firms listed in the Stock Exchange of Thailand. The objective of this study is to examine the factors that influence investor expectations of receiving dividends and the likelihood of firms paying dividends in the future.

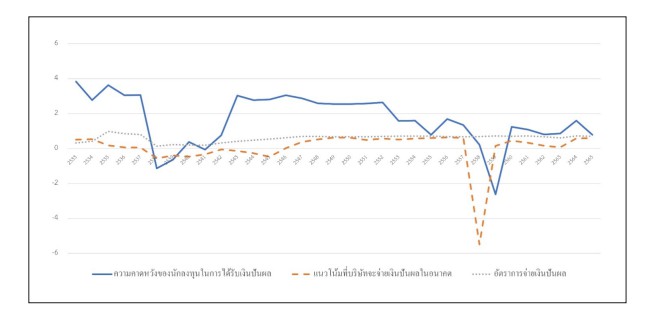

The findings indicate that investor expectations of receiving dividends are influenced by a firm's investment opportunities, average size, and profitability. These factors raise investor expectations that the firm will pay dividends in the future. Moreover, the study identifies that a firm's investment opportunity, growth opportunities, average size, and profitability are factors that encourage the firm to pay dividends. The results are consistent with the study of Baker and Wurgler (2004b), except for the growth rate of total assets. This study reveals that the growth prospects of the firm have a positive association with its future prospects for dividend payments in Thailand. In contrast, developed countries predict an inverse relationship between dividend payment and the firm's growth rate. But the high-growth rate firms in Thailand can pay high dividends as they have the capability to expand their business and maintain their growth rate simultaneously.

This study contributes to the literature by providing insights into the factors that influence investor expectations of receiving dividends and the likelihood of firms paying dividends in the Stock Exchange of Thailand. The results could be beneficial to policymakers, investors, and firms in their decision-making process regarding dividends.

References

Baker, M., & Wurgler, J. (2004a). A catering theory of dividends. The Journal of Finance, 59(3), 1125-1165. https://doi.org/10.1111/j.1540-6261.2004.00658.x

Baker, M., & Wurgler, J. (2004b). Appearing and disappearing dividends: The link to catering incentives". Journal of Financial Economics, 73(2), 271-288. https://doi.org/10.1016/j.jfineco.2003.08.001

Eugene F. Fama and Kenneth R. French (2001). Disappearing dividends: changing firm characteristics or lower propensity to pay?". Journal of Financial Economics, 60, 3-43. https://doi.org/10.1016/S0304-405X(01)00038-1

Gerald R. Jensen, Donald P. Solberg and Thomas S. Zorn. (1992). Simultaneous Determination of Insider Ownership, Debt, and Dividend Policies. The Journal of Financial and Quantitative Analysis Vol. 27, No. 2 (Jun., 1992), 247-263. https://doi.org/10.2307/2331370

John Y. Campbell. (2000). Asset Pricing at the Millennium.. The journal of Finance. Volume55, Issue4 August 2000, 1515-1567. https://doi.org/10.1111/0022-1082.00260

Neil C. Churchill and Virginia L. Lewis. (1983). The Five Stages of Small Business Growth. Harvard Business Review, 61, 30-50.

Nareerath Assavatanalab (2015) Managerial Ownership And Dividend Policy. An Independent Study Submitted In Partial Fulfillment Of The Requirements For The Degree Of Masters Of Accounting Faculty Of Commerce And Accountancy Thammasat University.

Naphasin Santiwat (2021). Dividend Signaling Theory, Maturity Hypothesis, Future Earning Change, Dividend Payout Ratio. Creative Business and Sustainability Journal Volume 43, No. 3, Issue 169 (July - September 2021), 1-21.

Sariya Nuanthawin (2019). The Effect of Financial Ratio on Dividend Payment of the Thai Listed Companies, sSET Index. Pathumthani University Academic Journal. Vol. 12 No. 1 (January-June 2020). 304-318.

Stephen P. Ferris, Narayanan Jayaraman and Sanjiv Sabherwal (2009). Catering effects in corporate dividend policy: The international evidence. Journal of Banking & Finance, 33, 1730-1738. https://doi.org/10.1016/j.jbankfin.2009.04.005