The study of the profitability of practical “Sell in May and Go Away” trading strategies in the Stock Exchange of Thailand

Abstract

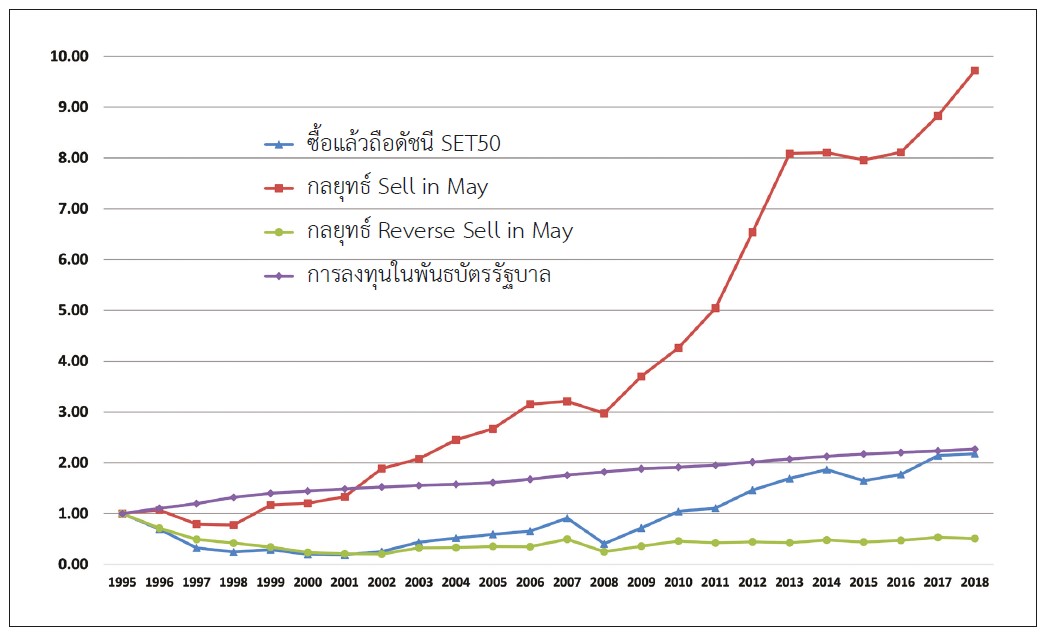

This study examines the profitability of various practical “Sell in May and Go Away” strategies in SET50 index of the Stock Exchange of Thailand (SET) from 1995-2018. Firstly, the study found empirical evidence that supports “Sell in May” effect, consistent with the evidence by Bouman and Jacobsen (2002) and Jenwittayaroje (2017). This study shows that the average of SET50 index total return is -1.36% in May-October period, but as high as 9.74% in November-April period. In addition, this study investigates the profitability of a number of practical Sell-in-May trading strategies, using TDEX (from 2007-2018) and SET50 Index Futures (from 2006-2018) as a proxy for SET50 index investment, and for leverage purposes. The empirical results of this study show that these practical Sell-in-May trading strategies have higher returns but with much lower risk (as measured by Standard Deviation of returns and CAPM beta) than the TDEX investing strategy. Therefore, such practical Sell-in-May trading strategies can provide a positive and statistically significant Jensen’s Alpha from 0.2% to 5.7% per half year, or about 0.4% to 11.4% per year.

References

Jenwittayaroje, N. (2017). "The study of "Sell in May" in the Stock Exchange of Thailand". NIDA Business Journal, Vol. 20 (May), pp 117-132.

Andrade, S.C., Chhaochharia, V., & Fuerst, M. E. (2013). "Sell in May and Go Away" just won't go away. Financial Analysts Journal 69(4), 94-105. https://doi.org/10.2469/faj.v69.n4.4

Bouman, S., & Jacobsen, B. (2002). The Halloween indicator, "Sell in May and Go Away": Another puzzle. American Economic Review 92(5), 1618-1635. https://doi.org/10.1257/000282802762024683

Dichtl, H., & Drobetz, W. (2015). Sell in May and go away: still good advice for investors? International Review of Financial Analysis 38, 29-43. https://doi.org/10.1016/j.irfa.2014.09.007

Haggard, K.S., & Witte, H.D. (2010). The Halloween effect: trick or treat? International Review of Financial Analysis 19, 379-387. https://doi.org/10.1016/j.irfa.2010.10.001

Haggard, K.S., Jones, J.S., & Witte, H.D. (2015). Black cats or black swans? Outliers, seasonality in return distribution properties, and the Halloween effect. Managerial Finance 41(7), 642-657. https://doi.org/10.1108/MF-07-2014-0190

Jacobsen, B., & Visaltanachoti, N. (2009). The Halloween effect in U.S. sectors. The Financial Review 44(3), 437-459. https://doi.org/10.1111/j.1540-6288.2009.00224.x

Jacobsen, B., & Zhang, C.Y. (2018). The Halloween indicator, "sell in May and go away": everywhere and all the time. Working paper, Massey University.

Jones, C.P., & Lundstrum, L.L. (2009). Is "Sell in May and Go Away" a valid strategy for U.S. equity allocation? Journal of Wealth Management 12(3), 104-112. https://doi.org/10.3905/jwm.2009.12.3.104

Maberly, E.D., & Pierce, R.M. (2004). Stock market efficiency withstands another challenge: Solving the "Sell in May/Buy after Halloween" puzzle. Econ Journal Watch 1(1), 29-46.

Witte, H.D. (2010). Outliers and the Halloween Effect: comment on Maberly and Pierce. Econ Journal Watch 7(1), 91-98.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2019 https://creativecommons.org/licenses/by-nc-nd/4.0/

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.