The Relationship between Corporate Social Responsibility Performance and Financial Performance of Listed Companies in Thailand

Keywords:

Corporate Social Responsibility, CSR Performance, Financial PerformanceAbstract

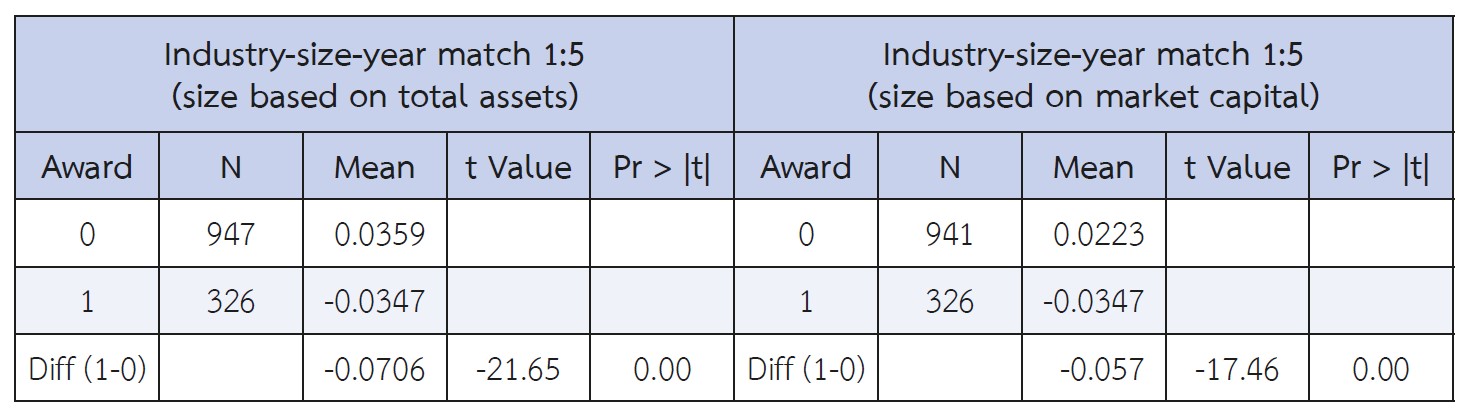

This study investigates the relationship between corporate social responsibility (CSR) performance and financial performance of listed companies in Thailand. CSR award, CG award, Sustainability award, and Thailand Sustainability Investment (THSI) are proxies for corporate social responsibility performance. Return on Assets (ROA), Return on Equity (ROE), sales growth, revenue growth, 3-day cumulative abnormal return, and 1 year, 3 years, and 5 years cumulative abnormal return are proxies for financial performance. The results show that CSR performance has a positive relationship with ROA for sample with industry-year-size match. However, there is insufficient evidence of a relationship between CSR performance and cumulative 1 year, 3 years, and 5 years abnormal returns. For event study using 3-day cumulative abnormal return around the announcement of award day, investors in agricultural and food industry, and property and construction industry react positively to the award news. On the contrary, investors in industrial, resources, services and technology industries react negatively to the award news.

References

Abbott, W. F., & Monsen, R. J. (1979). On the measurement of corporate social responsibility: Self-reported disclosures as a method of measuring corporate social involvement. Academy of management journal, 22(3), 501-515. https://doi.org/10.2307/255740

Brammer, S., Brooks, C., & Pavelin, S. (2006). Corporate social performance and stock returns: UK evidence from disaggregate measures. Financial management, 35(3), 97-116. https://doi.org/10.1111/j.1755-053X.2006.tb00149.x

Cochran, P. L., & Wood, R. A. (1984). Corporate social responsibility and financial performance. Academy of management Journal, 27(1), 42-56. https://doi.org/10.2307/255956

Griffin, J.J. and Mahon, J.F., 1997. The corporate social performance and corporate financial performance debate: Twenty-five years of incomparable research. Business & society, 36(1), pp.5-31. https://doi.org/10.1177/000765039703600102

Janamrung, B., & Issarawornrawanich, P. (2015). The association between corporate social responsibility index and performance of firms in industrial products and resources industries: empirical evidence from Thailand. Social Responsibility Journal, 11(4), 893-903. https://doi.org/10.1108/SRJ-11-2013-0141

Kinder, P. Lydenberg, S. & Domini, A. (2003). KLD Rating Data: Inclusive Social Rating Criteria, KLD Research and Analytics.

Klassen, R. D., & McLaughlin, C. P. (1996). The impact of environmental management on firm performance. Management science, 42(8), 1199-1214. https://doi.org/10.1287/mnsc.42.8.1199

Kramer, M. R., & Porter, M. E. (2006). Strategy and society. Harvard Business Review, (84).

Makni, R., Francoeur, C., & Bellavance, F. (2009). Causality between corporate social performance and financial performance: Evidence from Canadian firms. Journal of Business Ethics, 89(3), 409. https://doi.org/10.1007/s10551-008-0007-7

McGuire, J. B., Sundgren, A., & Schneeweis, T. (1988). Corporate social responsibility and firm financial performance. Academy of management Journal, 31(4), 854-872. https://doi.org/10.2307/256342

Mongkolkachit, P. (2016). The Impact of Corporate Social Responsibility on Firm Performance: Empirical Study of Thai Public Listed Companies. Veridian e-Journal ฉบับ ภาษา ไทย สาขา มนุษยศาสตร์ สังคมศาสตร์ และ ศิลปะ และ ฉบับ International Humanities, Social Sciences and arts, 9(5), 24-36.

Moskowitz, M. (1972). Choosing socially responsible stocks. Business and Society Review, 1(1), 71-75.

Preston, L. E., & O'bannon, D. P. (1997). The corporate social-financial performance relationship: A typology and analysis. Business & Society, 36(4), 419-429. https://doi.org/10.1177/000765039703600406

Ruf, B.M., Muralidhar, K., Brown, R.M., Janney, J.J. and Paul, K., 2001. An empirical investigation of the relationship between change in corporate social performance and financial performance: A stakeholder theory perspective. Journal of business ethics, 32(2), pp.143-156. https://doi.org/10.1023/A:1010786912118

SET. 2016. SET. [ONLINE] Available at: https://www.set.or.th/sustainable_dev/th/sr/sd/awards_p1.html [Accessed 30 March 2019].

Turban, D.B. and Greening, D.W., 1997. Corporate social performance and organizational attractiveness to prospective employees. Academy of management journal, 40(3), pp.658-672. https://doi.org/10.5465/257057

Ullmann, A.A., 1985. Data in search of a theory: A critical examination of the relationships among social performance, social disclosure, and economic performance of US firms. Academy of management review, 10(3), pp.540-557. https://doi.org/10.5465/amr.1985.4278989

Vance, S. C. (1975). Are socially responsible corporations good investment risks? Management review, 64(8), 19-24.

Waddock, S. A., & Graves, S. B. (1997). The corporate social performance-financial performance link. Strategic management journal, 18(4), 303-319. https://doi.org/10.1002/(SICI)1097-0266(199704)18:4<303::AID-SMJ869>3.0.CO;2-G

https://epi.envirocenter.yale.edu/2018/report/category/hlt. 2018. Environmental Performance Index. [ONLINE] Available at: https://epi.envirocenter.yale.edu. [Accessed 15 May 2018].

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2020 https://creativecommons.org/licenses/by-nc-nd/4.0/

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.