The Effects of expiration of IPO Silent Period on Abnormal Return and Cumulative Abnormal Returns of Listed Companies on the Stock Exchange of Thailand and the Market for Alternative Investment

Keywords:

IPO Silent period, Abnormal returns, Cumulative abnormal returns, SET, MAIAbstract

This study examines market reaction during the expiration of the IPO silent period of 314 IPOs and examines the effect of various independent variables of 276 IPOs which comprises of logarithm of market capitalization (LogMKT) standard deviation of closing share price (S.D.Price) IPO initial return (IR) length of the lockups period (SPLenght) percent of the IPO shares lockups to paid-up capital after IPO (LockShare) proportion of percentage of shares that held by strategic shareholder (Shareholder) operating year of companies from the establishment to first trading day (Age) and dummy variable of underwriters (DumUnderwriter) on cumulative abnormal returns during the expiration of the IPO silent period of Thai listed companies during 2001 to 2017.

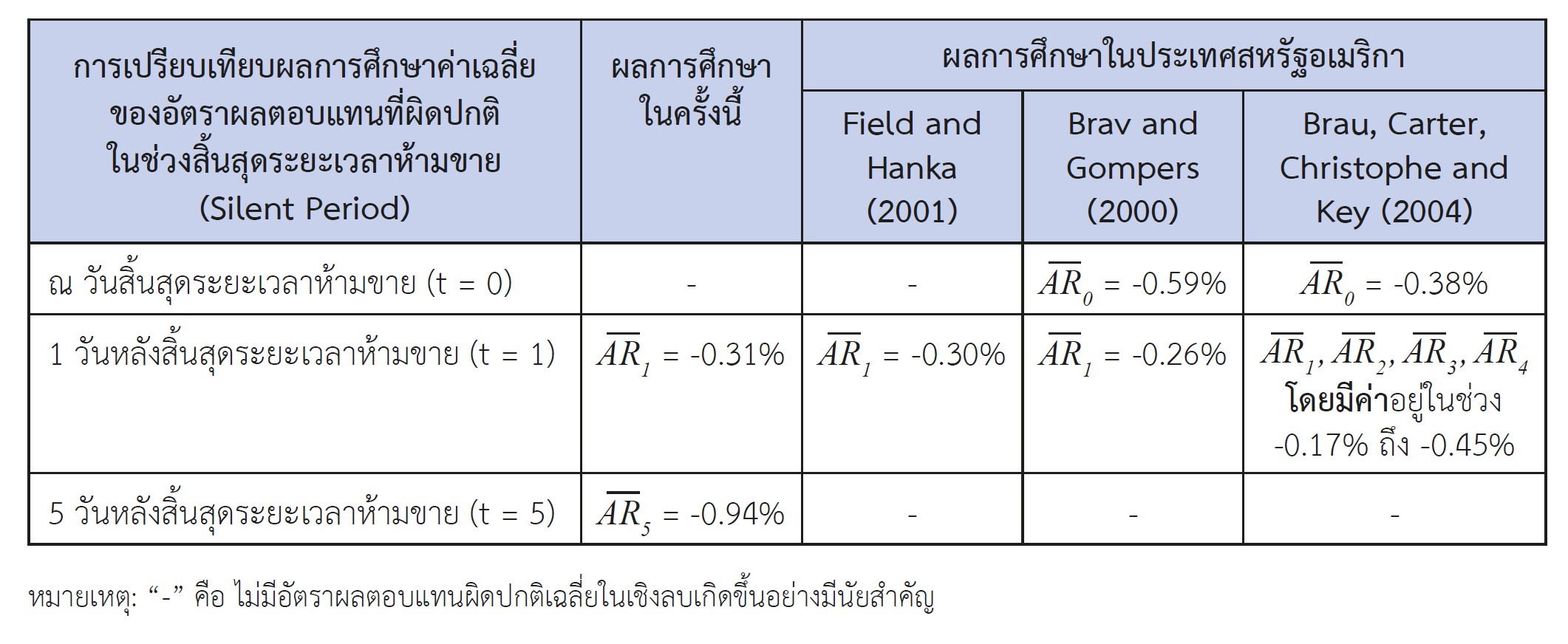

The results show that share prices declined during that period. Statistically, there are significant negative abnormal returns and cumulative abnormal returns. This may have been caused by changing in demand and supply from the selling of IPO shares locked up by directors and shareholders. This study also finds that the negative abnormal returns and cumulative abnormal returns exists only a short-term basis.

Moreover, through using multiple linear regression to test factors that have impact on cumulative abnormal returns, the results indicate that the statistical result also indicated that the length of the lockups period (SPLenght) has a significant negative relation with cumulative abnormal returns. The result is also consistent with information asymmetry in which longer lockups period will allow more efficiency to reflect the intrinsic value of the companies which affect the changing in demand and supply from the selling of IPO shares locked up by directors and shareholders because the opportunity to make profits from holding shares in the long run is unlikely to occur; which will probably result in the decrease in share prices.

References

Brau, J., C., Carter, D., A., Christophe, S., E., and Key, K., G., 2004. “Markets Reaction to the Expiration of IPO Lockup Provisions” Journal of Managerial Finance 30 : 75-91.

Brav, A., and Gompers, P., A., 2000. “Insider Trading Subsequent to Initial Public Offerings: Evidence from Expirations of Lock-Up Provisions” Working Paper.

Field, L., C., and Hanka, G., 2001. “The Expiration of IPO Share Lockups” Journal of Financial 56 : 471-500.

Hoque, H., and Lasfer, M., 2009. “Insider Trading Before IPO Lockup Expiry Dates: The UK Evidence” Working Paper.

Sirima Disara 2007. “Stock Reaction to the Expiration of IPO Lockup Period: Evidence in Thailand” Working Paper.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2020 https://creativecommons.org/licenses/by-nc-nd/4.0/

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.