Is Reverse Mortgage for Thai elderly?

Keywords:

Reverse Mortgage, Thai ElderlyAbstract

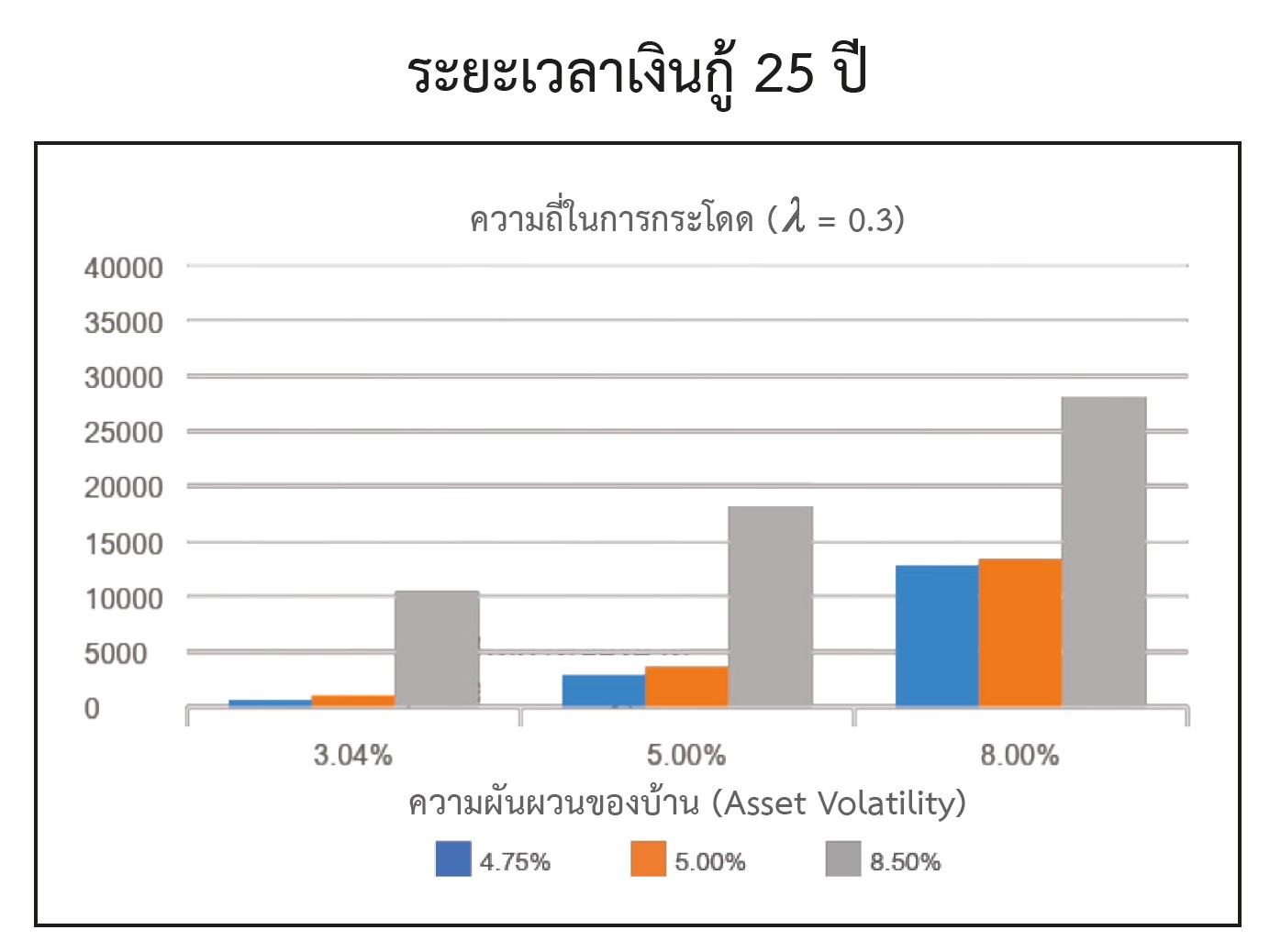

A reverse mortgage is a loan, pioneered in the United States, available to elderly homeowners that allows them to convert the equity in their homes into cash for their spending. Recently in Thailand, the Government Savings Bank has offered reverse mortgage to Thai elderly as one of the policy measures to prepare for the aging society. The objective of this study is to assess whether the loan is appropriate for Thai elderly. To provide the basis of understanding of the reverse mortgage offered by the Government Savings Bank, the study begins by explaining the reverse mortgage loan under the Home Equity Conversion Mortgage (HECM) program and reviewing previous studies in several areas. Then the study assesses the adequacy of the monthly incomes from the loan received by Thai elderly, using a simple example to compare the received incomes from the Government Savings Bank and those from the comparable HECM loans. It is found that the monthly incomes received under the HECM are higher than those of the Government Savings Bank. In addition, the study estimates the put option value of the borrower from the nonrecourse feature of the loan using various models. The simple closed-form Black-Scholes put option values are significantly lower than those of the simulation approach, due to the time-varying strike and non-European features of the loan. Moreover, the put values appear to be lower than the fixed transaction costs of the loan, even in the case of allowing for the jump in housing price such as in the crisis. Overall the results suggest that the Reverse Mortgage loan is too expensive for Thai elderly. The government should consider the mortgage insurance program which enables banks to lend on more favorable terms.

References

Campbell, John Y. 2006. “Household Finance.” Journal of Finance: 61, 1553 - 1604.

Case, Bradford, and Ann B. Schnare. 1994. “Preliminary evaluation of the HECM reverse mortgage program.” Journal of the American Real Estate and Urban Economics Association: 22(2), 301–346.

Choi, James J., David Laibson and Brigitte C. Madrian. 2011. “$100 Bills on the Sidewalk: Suboptimal Investment in 401(k) Plans.” Review of Economics and Statistics: 93, 748 - 763.

Consumer Financial Protection Bureau. 2015. “A closer look at reverse mortgage advertisements and consumer risks.” Office for Older Americans

Davidoff, Thomas. 2015. “Can 'High Costs' Justify Weak Demand for the Home Equity Conversion Mortgage?” Review of Financial Studies: 28, 2364-2398.

Davidoff, Thomas, Patrick Gerhard and Thomas Post. 2017. “Reverse mortgages: What homeowners (don’t) know and how it matters.” Journal of Economic Behavior & Organization: 133, 151-171.

DeNavas-Walt, C., Proctor, B. and Lee, C. 2006. Income, Poverty, and Health Insurance Coverage in the United States: 2005, Current Population Reports, P60-231, U.S. Census Bureau.

Haurin, Donald, Chao Ma, Stephanie Moulton, Maximilian Schmeiser, Jason Seligman and Wei Shi. 2016. “Spatial Variation in Reverse Mortgages Usage: House Price Dynamics and Consumer Selection,” Journal of Real Estate Financial Economics: 53, 392 - 417.

Johnson, Eric, Stephan Meier, and Olivier Toubia (2016) ,"Leaving Money on the Kitchen Table: Exploring Sluggish Mortgage Refinancing Using Administrative Data, Surveys, and Field Experiments", in NA - Advances in Consumer Research Volume 44, eds. Page Moreau and Stefano Puntoni, Duluth, MN : Association for Consumer Research, Pages: 179-184.

Keys, Benjamin C., Devin G. Pope, and Jared C. Pope. 2016. “Failure to Refinance.” Journal of Financial Economics 122 (2016), 482–499.

Laibson, David. 1997. “Golden Eggs and Hyperbolic Discounting.” Quarterly Journal of Economics: 112(2), 443-77.

Lucas, Deborah. 2016. “Hacking Reverse Mortgages.” Working paper. MIT Golub Center for Finance and Policy.

Michelangeli, Valentina. 2008. “Does It Pay to Get a Reverse Mortgage?” Unpublished manuscript, Boston University.

Nakajima, Makoto and Irina Telyukova. 2017. “Reverse Mortgage Loans: A Quantitative Analysis.” Journal of Finance: 72 (2), 911-950.

Redfoot, Donald L., Ken Scholen, and S. Kathi Brown. 2007. “Reverse mortgages: Niche product or mainstream solution?” Report on the 2006 AARP National Survey of Reverse Mortgage Shoppers, AARP Public Policy Institute.

Shan, Hui. 2011. “Reversing the trend: The recent expansion of the reverse mortgage market.” Real Estate Economics: 39, 743–768.

Tirapat, Sunti and Suparattana Tanthanongsakkul. 2017. Reverse Mortgage for Thai Elderly. Foundation of Thai Gerontology Research and Development Institute (in Thai).

Warshawsky, Mark J. 2017. “Retire on the House: The Possible Use of Reverse Mortgages to Enhance Retirement Security.” Working Paper, Mercatus Center at George Mason University, Arlington, VA.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2020 https://creativecommons.org/licenses/by-nc-nd/4.0/

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.