Earnings Management Through Discretionary Accruals: Evidence From Rehabco Firms In The Stock Exchange Of Thailand

Keywords:

Earning Management, Discretionary Accruals, REHABCO Firms, Modified Jones Model (1995)Abstract

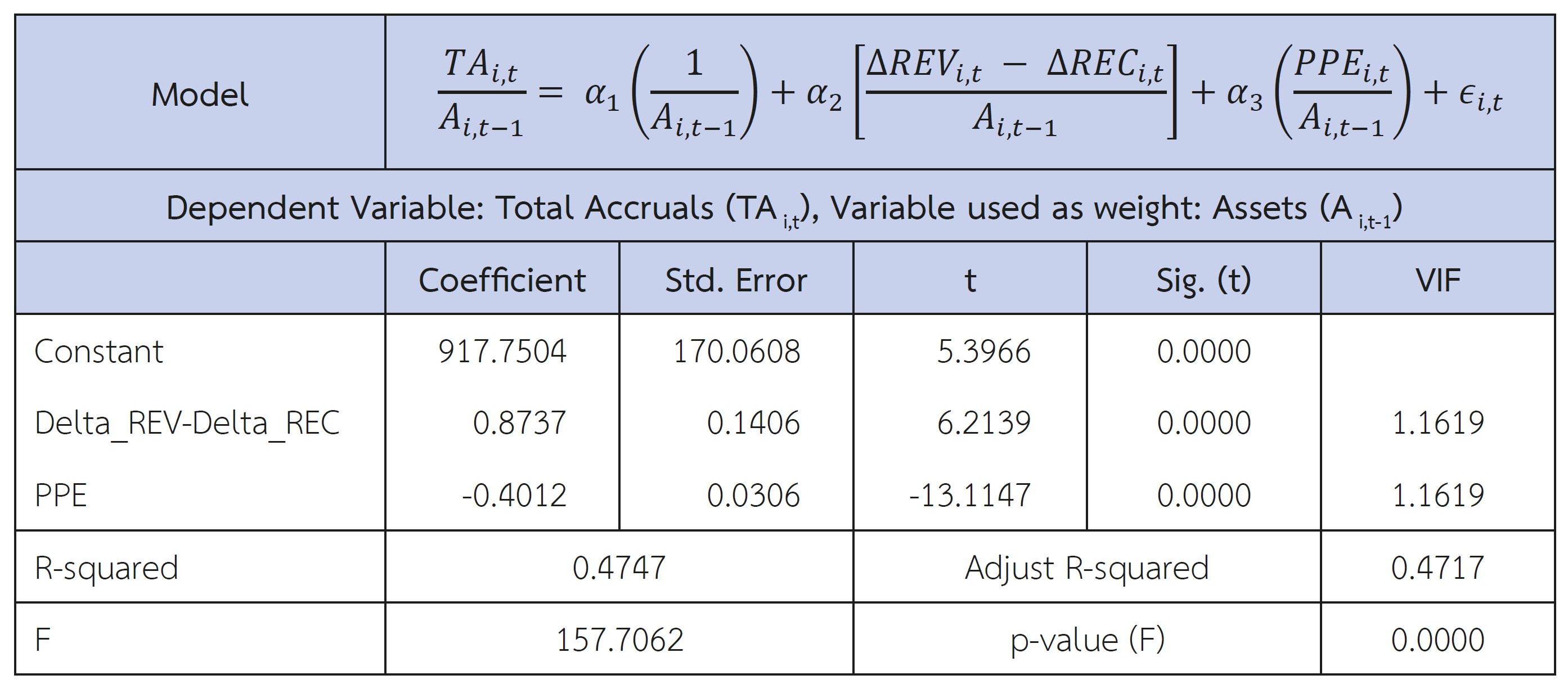

This study aims to investigate trend and size of earnings management and also examines factor influencing earnings management through discretionary accruals of REHABCO firms (firms under rehabilitation process) in the Stock Exchange of Thailand using The Modified Jones Model (1995) from 2011 to 2016 by comparing with Non-REHABCO firms in the similar size and same industry included 44 firms 264 firm-year observation using matched pairs t-test and multiple regression analysis.

The results found that the mean of earnings management of REHABCO firms tend to increase while discretionary accruals is negative and the size of earnings management are statistically significant larger than Non-REHABCO firms. Furthermore, at the 95% confidence level, there is a positive significant relationship between firms under rehabilitation process and earnings management. In addition, factors influencing earnings management through discretionary accruals of REHABCO firms are return on total asset and firm size. The findings revealed that return on total asset and firm size are positively correlated to earnings management while cash flow from operation, audit firm size, and gain on debt restructuring are negatively correlated to earnings management.

References

Aharony, J., Lin, C. J., & Loeb, M. P. (1993). Initial Public Offerings, Accounting Choices and Earnings Management. Contemporary Accounting Research, 10(1), 61-81.

Ahmed, R.B. (2004). Accounting Theory. 5th ed. United Kingdom: Thomson.

Ajit, D., Sarat, M., & Vimal, K.V. (2013). Earning Management in India. SEBI DRG Study, 1 – 27. Retrieved June 20, 2014 from http://www.sebi.gov.in/cms/sebi_data/DRG_Study/EMiM.pdf.

Aroonjit, W. (2005). The Relationship between Audit Firm Size, Firm Size and Earnings Management: Case of Listed Companies in the Stock Exchange of Thailand. Thesis of Master of Accountancy Program, Chulalongkorn University.

Awidat, M., & Vladan, P. (2013). Earning Management vs Financial Reporting Fraud Key Features for Distinguishing. Economics and Organization, 10(1), 39-47.

Bartov, E., Gul, F. A., & Tsui, J.S.L. (2000). Discretionary-Accruals Models and Audit Qualifications. Journal of Accounting and Economics, 30(3), 421-452.

Bauwhede, H.V., Marleen, W., & Gaeremynck, A. (2003). Audit Firm Size Public Ownership, and Firms' Discretionary Accruals Management. The International Journal of Accounting, 38, 1-22.

Bergstresser, D., & Philippon, T. (2006). CEO Incentives and Earnings Management. Journal of Financial Economics, 80, 511–529.

Cheng, Q., Warfield, T., & Ye, M. (2005). Equity Incentives and Earnings Management. The Accounting Review, 80, 441-476.

Dechow, P. M., Sloan, R. G., & Sweeney, A. P. (1995). Detecting Earnings Management. The Accounting Review. 70: 193-225.

Elias, S., Jamal, B. K., & Mohammad, H. (2013). The Study of Relationship between Annual Adjustments in Financial Statements and Earning Management. Interdisciplinary Journal of Contemporary Research in Business, 5(4), 275 - 283.

Essam, E., & Emmanuel, N. (2014). Are Discretionary Accruals a Good Measure of Audit Quality?. Journal of Management Policy and Practice, 15(2), 43-59.

Guay, W., S. P. Kothari, & R.L. Watts. (1996). A Market-Based Evaluation of Discretionary Accruals Model. Journal of Accounting Research, 34, 83-105.

Hashem, N., Bahman, B., & Azam, S. (2012). An Empirical Analysis of Earnings Management Motives in Firms Listed on Tehran Stock Exchange. Journal of Basic and Applied Scientific Research, 2(10), 9990 – 9993.

Healy, P.M., & Wahlen, J. M. (1999). A Review of the Earnings Management Literature and Its Implications for Standard Setting. Accounting Horizons, 13(4), 365-383.

Jaggi, B. & Lee, P. (2002). Earnings Management Response to Debt Covenants and Debt Restructuring. Journal of Accounting, Auditing & Finance, 17, 295-324.

Jiang, J., Petroni, K.R., & Wang, I.Y. (2010). CFOs and CEOs: Who Have the Most Influence on Earnings Management?. Journal of Financial Economics, 96, 513-526.

Kampanatkoson, K. (2007). Earnings Management and Leverage Ratio. Independent Study of Master of Accounting Program, Thammasat University.

Kate, J. (2007). The Effect of Leverage Increases on Earning Management. Journal of Business & Economic Studies, 13(2), 24-46.

Komkhuntod, S. (2012). Factors that Affect Earnings Management through Accruals of Companies Listed on the Stock Exchange of Thailand, Which was ordered to edit the Financial Statements. Thesis of Master of Accountancy Program, Khon Kaen University.

Maneemai, P., & Sriworadetpisan, S. (2009). Earnings Management of Financial Distressed Firms during Debt Restructuring Negotiation. Academic Journal of University of the Thai Chamber of Commerce, 29(4), 1-21.

Merchant, K. A., & Rockness, J. (1994). The Ethics of Managing Earnings: an Empirical Investigation. Journal of Accounting and Public Polky, 13(1), 79-94.

Peasnell, K., Popoe, P., & Young, S. (2000). Accrual Management to Meet Earnings Targets: UK Evidence Pre-and Post-Cadbury. British Accounting Review, 32, 415-445.

Park, M. S., & Ro, B. T. (2004). The Effect of Firm-Industry Earning Correlation and Announcement Timing on Firm's Accrual Dicision. The British Accounting Review, 36, 269-289.

Pratomsrimek, S. (2005). Factor Leading to the Success in Rehabilitation Process: An Empirical Evidence from the Stock Exchange of Thailand. Ph.D. Dissertation, Department of Accountancy, Chulalongkron University.

Richardson, S. A., Sloan, S. G., Soliman, M., & Tuna, I. (2005). Accrual Reliability Earnings Persistence and Stock Prices. Journal of Accounting and Economics, 39, 437-485.

Ronen, J., & Yaari, V. (2008). Earnings Management: Emerging Insights in Theory, Practice and Research. New York: Springer Science and Business Media.

Schipper, K. (1989). Earnings Management. Accounting Horizons, 3 (4), 91-102.

Sundod, J. (2005). The Relationship between Financial Performances and Accounting Accruals. Thesis of Master of Accountancy Program, Chulalongkorn University.

Sylvia, V.S., & Sidharta, U. (2008). Type of Earning Management and the Effect of Ownership Structure, Firm Size, and Corporate-Governance Practices: Evidence from Indonesia. The International Journal of Accounting, 43, 1-27.

TanTana, P. (2011). Earnings Management by Accruals of Initial Public Offering Firms in the Stock Exchange of Thailand. Thesis of Master of Accountancy Program, Kasetsart University.

Tummanon, V. (2000). Did you know Creative Accounting and Earning Quality?. Ionic Inter Trade Resources, Bangkok.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2020 https://creativecommons.org/licenses/by-nc-nd/4.0/

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.