Barriers and Drivers of e-Tax System Acceptance: A Quantitative Case Study from Thailand

Keywords:

e-Tax invoice, e-Tax invoice by e-mail, Electronics invoicing, e-Tax invoice systemAbstract

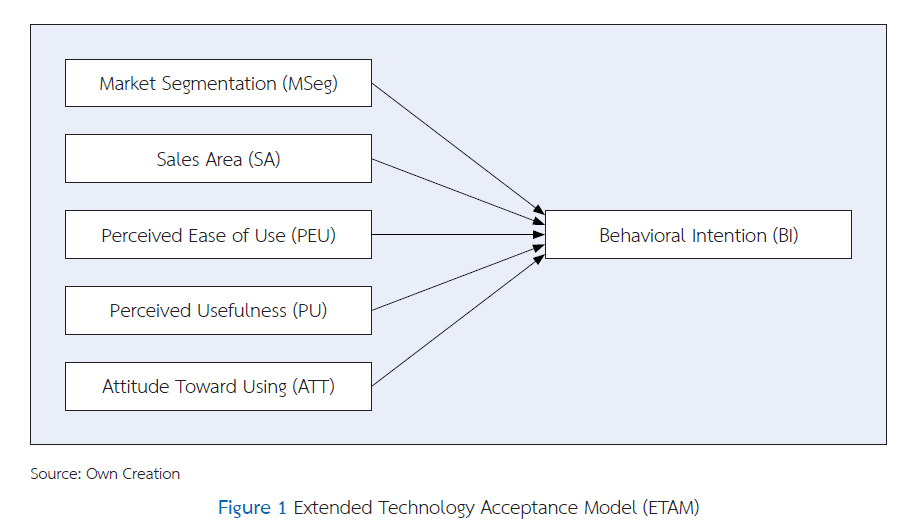

This quantitative case-study research examines the factors that influenced customer acceptance of the e-Tax invoice by e-mail channel during Company XYZ’s 2022 implementation in Thailand. Data from 251 corporate clients in five Sales Areas (SA) were analyzed with multiple regression and one-way ANOVA. Perceived Usefulness (PU) (β = .19, p = .001), Perceived Ease of Use (PEOU) (β = .21, p = .001) and Attitude Toward Using (ATT) (β = .54, p < .001) all showed significant positive effects on Behavioral Intention (BI) and together explained 49 percent of its variance. Tukey post-hoc tests revealed that clients in Bangkok and Vicinity, the Central region and the East scored higher on intention than those in the North and Northeast (p < .001), underscoring a regional digital divide that complicated deployment. The results indicate that seamless system integration, low set-up effort and positive user attitudes were critical success factors, whereas weak infrastructure in the North and Northeast remained a major barrier. Recommendations include bundling digital-signature certificates with onboarding and partnering with regional internet service providers. The findings offer transferable lessons for other Thai SMEs planning similar e-Tax implementations.

References

Ajzen, I., & Fishbein, M. (2000). Attitudes and the attitude-behavior relation: Reasoned and automatic processes. European Review of Social Psychology, 11(1), 1–33. https://doi.org/10.1080/14792779943000116

Brislin, R. W. (1986). The wording and translation of research instruments. In W. J. Lonner & J. W. Berry (Eds.), Field Methods in Cross-Cultural Research (pp. 137–164). Sage Publications.

Chakpitak, N., Maneejuk, P., Chanaim, S., & Sriboonchitta, S. (2018). Thailand in the era of digital economy: How does digital technology promote economic growth? Predictive Econometrics and Big Data TES2018, 350–362. https://doi.org/10.1007/978-3-319-70942-0_25

Chuttur, M. (2009). Overview of the Technology Acceptance Model: Origins, Developments and Future Directions. Sprouts: Working Papers on Information Systems, 9(37), Article 37.

Davis, F. D. (1989). Technology acceptance model. TAM [Working Paper 529].

Gaur, S., & Tiwari, S. P. (2006). Consumers effortful decision making and self-regulatory orientation. Indian Institute of Technology, 3598–3604. https://doi.org/10.1007/978-3-030-67238-6_5

Gunaratne, H., & Pappel, I. (2020). Enhancement of the e-invoicing systems by increasing the efficiency of workflows via disruptive technologies. International Conference on Electronic Governance and Open Society: Challenges in Eurasia, 60–74.

Hair, J. F., Babin, B. J., Anderson, R. E., & Black, W. C. (2019). Multivariate data analysis (8th ed.). Pearson.

Jantavongso, S., Nuansomsri, C., Kasemsawasdi, S., Anekritmongkol, S., & Sitthikraiwong, S. (2016). eBusiness adoption studies in Thailand. In Knowledge Management International Conference (KMICe) 2016, Chiang Mai, Thailand.

Jongwanich, J. (2022). The economic consequences of globalization on Thailand. Routledge. https://doi.org/10.4324/9781003144076

Khamta, M., & Wattanakulchai, M. (2018). Knowledge and understanding in e-taxation of accounting students in digital 4.0 era. http://dspace.rmutk.ac.th/handle/123456789/2538

Koch, B. (2017). Business case e-invoicing/e-billing. Billentis, 2017, 1–27.

Koch, B. (2019). The e-invoicing journey 2019-2025. Preuzeto, 25, 2021.

Krejcie, R. V., & Morgan, D. W. (1970). Determining sample size for research activities. Educational and Psychological Measurement, 30(3), 607–610. https://doi.org/10.1177/001316447003000308

Lee, M., & Schuele, C. M. (2010). Demographics. Encyclopedia of Research Design, 3, 2–4.

Mamman, M. (2016). Factors Influencing Customer’s Behavioral Intention to Adopt Islamic Banking in Northern Nigeria: A Proposed Framework. IOSR Journal of Economics and Finance (IOSR-JEF), 7(1), Article 1.

Mankhong, G. (2018). A study of components affecting adoption of electronic tax invoice processing and delivery system (e-tax invoice) of entrepreneur In Kamphaeng Phet Province. http://libdoc.dpu.ac.th/thesis/Ganya.Man.pdf

Matsson, E., Dahllöf, G., & Nilsson, J. (2015). Business to business-electronic invoice processing: A report on the challenges, solutions and outcomes for companies switching from manual to electronic invoice handling. Jönköping University.

McCombes, S. (2019). Sampling methods | types, techniques & examples. Scribbr. https://www.scribbr.com/methodology/sampling-methods/

Morshed, A., Ramadan, A., Maali, B., Khrais, L., & Baker, A. (2024). Transforming accounting practices: The impact and challenges of business intelligence integration in invoice processing. Journal of Infrastructure, Policy and Development, 8(6), 4241. https://doi.org/10.24294/jipd.v8i6.4241

Nunnally, J. C. (1978). An overview of psychological measurement. Clinical Diagnosis of Mental Disorders: A Handbook, 97–146. https://doi.org/10.1007/978-1-4684-2490-4_4

Panithanrakchai, W., & Penwutikul, P. (2020). Itthiphon khong thaksa dan phasi akon thi songphon to prasitthiphap kanpatibat ngan nai rabop bai kamkab phasi elektronik thang imeo khong phu tham banchee nai khet Krung Thep Maha Nakhon lae parimonthon [The influence of tax skills on work efficiency in the electronic tax invoice via email system of accountants in Bangkok and metropolitan areas]. Mahachula Academic Journal, 7(2), Article 2.

Pantucha, N. (2020). Effects of tax system and e-documents success on accounting operational efficiency of electronic tax registrants. http://202.28.34.124/dspace/handle123456789/1190

Phonthanukitithaworn, C., Sellitto, C., & Fong, M. W. (2016). An investigation of mobile payment (m-payment) services in Thailand. Asia-Pacific Journal of Business Administration, 8(1), 37–54. https://doi.org/10.1108/APJBA-10-2014-0119

Salkind, N. J., & Frey, B. B. (2021). Statistics for people who (think they) hate statistics: Using Microsoft Excel. Sage publications.

Sawyer, S. F. (2009). Analysis of variance: The fundamental concepts. Journal of Manual & Manipulative Therapy, 17(2), 27E-38E. https://doi.org/10.1179/jmt.2009.17.2.27E

Sharma, L. R. (2023). Choosing appropriate probability sampling designs in research. Health, 2, 4–21.

Singh, A. S., & Masuku, M. B. (2014). Sampling techniques & determination of sample size in applied statistics research: An overview. International Journal of Economics, Commerce and Management, 2(11), 1–22.

Smith, A. (2024). 1776 An Inquiry into the Nature and Causes of the Wealth of Nations. In Foundations of Monetary Economics, Vol. 1 (pp. 223–295). Routledge. https://doi.org/10.4324/9781003552246-6

Sondakh, J. (2017). Behavioral intention to use e-tax service system: An application of technology acceptance model. European Research Studies Journal, 20(2A), Article 2A.

Stolzenberg, R. M. (2004). Multiple regression analysis. Handbook of data analysis, 165–207. https://doi.org/10.4135/9781848608184.n8

Suki, N., & Ramayah, T. (2010). User Acceptance of the e-government services in Malaysia: Structural equation modelling approach. Interdisciplinary Journal of Information, 5, 395–413. https://doi.org/10.28945/1308

Sukkomol, S. (2019). Factor Affecting Acceptance of Technology and Decision to Use e-Tax Invoice & e-Receipt [Unpublished master' s thematic paper]. College of Innovative Business and Accountancy, Dhurakij Pundit University.

Susanto, T. D., Diani, M. M., & Hafidz, I. (2017). User acceptance of e-government citizen report system (a case study of city113 app). Procedia Computer Science, 124, 560–568. https://doi.org/10.1016/j.procs.2017.12.190

Tan, M., & Teo, T. S. (2000). Factors influencing the adoption of Internet banking. Journal of the Association for Information Systems, 1(1), 5. https://doi.org/10.17705/1jais.00005

Teerapunyachai, B., & Bawornkitchaikul, Y. (2024). Innovations and resilience in Thailand’s payment ecosystem: A comprehensive analysis—Connectivity initiatives, challenges and solutions. Journal of Digital Banking, 9(1), 67–85. https://doi.org/10.69554/ASFL8618

Venkatesh, V., & Bala, H. (2008). Technology acceptance model 3 and a research agenda on interventions. Decision Sciences, 39(2), 273–315. https://doi.org/10.1111/j.1540-5915.2008.00192.x

Venkatesh, V., & Davis, F. D. (2000). A theoretical extension of the technology acceptance model: Four longitudinal field studies. Management Science, 46(2), 186–204. https://doi.org/10.1287/mnsc.46.2.186.11926

Vu, K., & Nguyen, T. (2024). Exploring the contributors to the digital economy: Insights from Vietnam with comparisons to Thailand. Telecommunications Policy, 48(1), 102664. https://doi.org/10.1016/j.telpol.2023.102664

Wailerdsak, N. (2023). Business groups and the Thailand economy: Escaping the middle-income trap. Routledge. https://doi.org/10.4324/9781003370536

Yutthana, S. (2021). Tax digitization in Thailand: The new change of e-tax invoice from ‘Analog’ to “Digital.” https://www.itax.in.th/media/tax-digitization-in-thailand-the-new-change-of-e-tax-invoice-from-analog-to-digital/

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 NIDA Business School, National Institute of Development Administration

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.