The Application of the Principal Component Analysis for Portfolio Investment Selection with Global ETF

Keywords:

portfolio selection, sector diversification, portfolio diversification, modern portfolio theory, principal components analysisAbstract

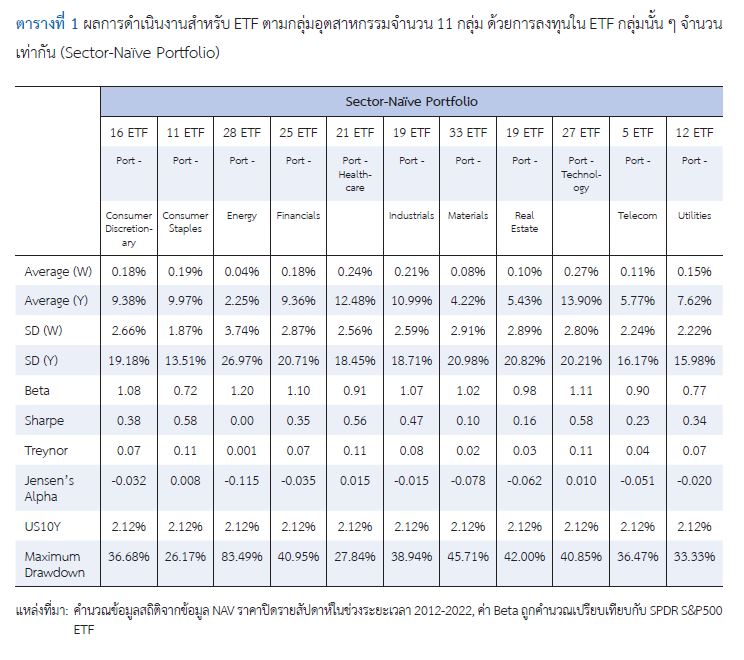

This study examines the application of Principal Component Analysis (PCA) in portfolio investment selection with Global ETFs. Using the weekly price data from 216 Global ETFs in the U.S. stock market during 2012–2022, the findings reveal that the Technology sector achieved the highest returns, while the Energy sector had the lowest returns and the highest risk. Consumer Staples exhibited the lowest risk. PCA enabled the selection of representative ETFs for each sector, resulting in an average portfolio correlation of 0.45. Incorporating PCA with Modern Portfolio Theory under the objective of maximizing the Sharpe Ratio of the portfolio, with the constraint of prohibiting short selling, it was found that increasing the investment weightings with an upper limit approach in two ETF sectors can lead to improved returns. Particularly, with an increase in allocation ranging from 10% to 50%, Consumer Staples Equities and Technology Equities in the Semiconductor industry, with an increase in allocation ranging from 3% to 17% can improve rate of return of the portfolio.

References

Canak, B., & Yilmaz, M. (2020). Principal Component Analysis (PCA) and its applications in stock portfolio selection and optimization. Journal of Financial Research, 33(1), 112-130.

Chen, H. (2014). Portfolio construction using Principal Component Analysis (Master’s project) Worcester Polytechnic Institute, United States.

Chicheportiche, R., & Bouchaud, J.-P. (2020). Nonlinear dynamics and criticality in financial markets. Journal of Statistical Mechanics: Theory and Experiment, 2020(8), 083403.

Gupta, R., & Basu, P. K. (2009). Sector analysis and portfolio optimization: The Indian experience. International Journal of Economics and Business Research, 8(1), 19-130. https://doi.org/10.19030/iber.v8i1.3096

Kaiser, H. F. (1960). The application of electronic computers to factor analysis. Educational and Psychological Measurement, 20, 141-151. https://doi.org/10.1177/001316446002000116

Kapoor, A. (2012). Diversification benefits of sector investments in Indian capital market. International Journal of Business and Management Cases, 1(2). https://doi.org/10.2139/ssrn.2067934

Komain Jiranyakul. (2002). Kānbō̜rihānkhwāmsīangnaiphō̜takānlongthun [Portfolio management strategy]. Thai Journal of Development Administration, 42 (Special Issue NIDA 36th Anniversary), 131-168. (in Thai)

Markowitz, H. (1952). Portfolio selection. The Journal of Finance, 7(1), 77-91. https://doi.org/10.2307/2975974

Meric, I., Dunne, K., McCall, C. W., & Meric, G. (2010). Performance of exchange-traded sector index funds in the October 9, 2007–March 9, 2009 bear market. Journal of Finance and Accountancy, 3, 1-10.

Meric, I. [Ilhan], Ding, J., & Meric, G. [Gulser]. (2016). Global portfolio diversification with emerging stock markets. Emerging Markets Journal, 6(1). https://doi.org/10.5195/emaj.2016.88

Meric, I., Dunne, K., McCall, C. W., & Meric, G. (2023). Hierarchical PCA and applications to portfolio management. Journal of Financial Data Science, 11(4), 240-257.

Piedboeuf, C. (2023). Portfolio Selection via Principal Component Analysis. Louvain School of Management, Université catholique de Louvain. Retrieved from Louvain Repository.

Roncalli, T. (2010). Understanding the impact of weights constraints in portfolio theory (Research & development). Evry University, Paris. https://doi.org/10.2139/ssrn.1761625

Sharma, R. (2023). Sectoral portfolio optimization by judicious selection of financial ratios via PCA. Journal of Financial Analysis, 48(2), 85-102.

Tan, J. (2012). Principal component analysis and portfolio optimization (Applied finance project). University of California, Berkeley. https://doi.org/10.2139/ssrn.2213687

Terada Pinyo. (2018). Theknik kān plǣ phon kān wikhro̜ ʻongprakō̜p samrap ngānwičhai [Techniques for interpreting factor analysis results for research]. Panyapiwat Journal, 10(Special Issue), 292-304. (in Thai)

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 NIDA Business School, National Institute of Development Administration

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.