The Relationship between Working Capital Management and Profitability: The Case of Listed Companies in Agro and Food Industry in Thailand

Keywords:

working capital management, profitability, hamburger crisisAbstract

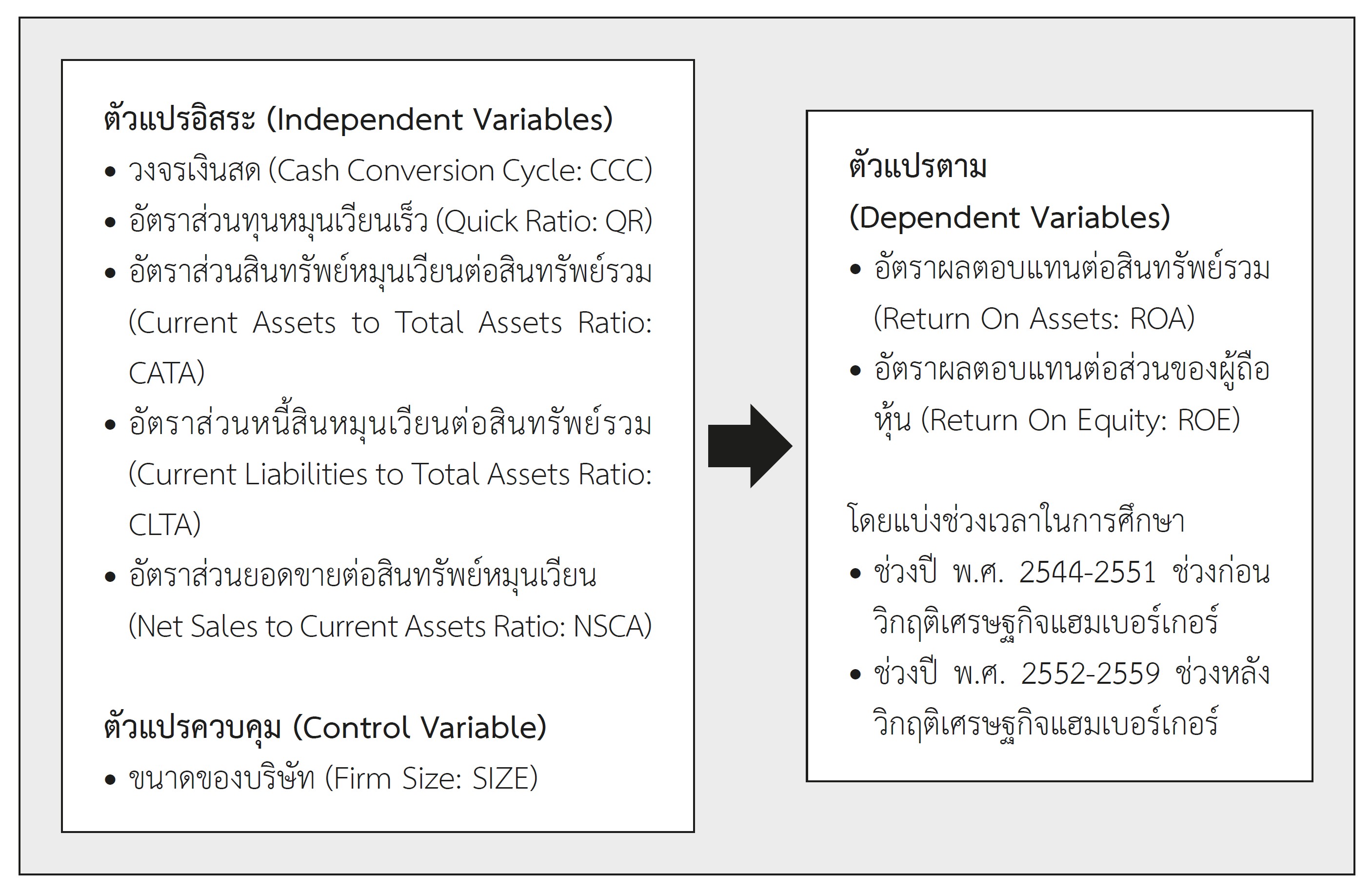

The study aims to explain the relationship between working capital management and profitability of listed companies in the Agro industrial in Thailand. The relationship with profitability (which is measured by return on assets and return on equity), the independent variables (namely cash conversion cycle), quick ratio, current assets to total assets ratio, current liabilities to total asset ratio and sales to current asset ratio along with the control variable (which is firm size) were used to conduct this study. The data of 28 listed companies covering 16 years from 2001-2016 have been collected by using a Panel regression analysis, specifically, the Random effect model. The result revealed a significant negative correlation between the cash conversion cycle and current liabilities to total assets with return on assets and return on equity. However, the results showed that current assets to total assets are positively associated with returns on assets and return on equity. The result implied that a business with a short cash cycle will receive money from the sale of goods in a short period, and will be able to support itself without relying on external funding, and will invest in current assets, increasing sales and accounts receivable. Thus, liquidity of working capital spending and debt repayment within due date, and profitability will be affected too. Additionally, during the pre-hamburger crisis period, the cash conversion cycle, quick ratio, current assets to total assets ratio, and current liabilities to total asset ratio were related to profitability more than during the post-crisis period.

References

Alavinasab, S. M. & Davoudi, E. (2013). Study the relationship between working capital management and profitability of listed companies in Tehran stock exchange. Faculty of Management, Qom College, University of Tehran, Iran.

Chareonwongsak, K. (2011). The effect of sub-prime crisis to the U.S. and Thai economies. Retrieved on May 13, 2017 from http://professorkriengsak.blogspot.com/2011/04/blog-post_8827.html.

Enqvist, J., Graham M. & Nikkinen, J. (2014). The impact of working capital management on firm profitability in different business cycles: evidence from Finland. Nordea Bank, Finland, School of Business Stockholm University, Sweden. & Department of Accounting and Finance, University of Vaasa, Finland. https://doi.org/10.1016/j.ribaf.2014.03.005

Federation of Accounting Professions. (2017). Financial Reporting Standards. Retrieved on June 8, 2017 from http://www.fap.or.th/index.php?lay=show&ac=article&Id=539920294&Ntype=58.

Jumreornvong, S. (2011). Corporate financial management: concepts and applications. Pathum Thani, Thammasat University Printing.

Kawswat, J. (2009). The Relationship between working capital management and profitability of listed companies on the Stock Exchange of Thailand. Master of Business Administration, Major Field: Finance, Department of Finance, Kasetsart University.

Kongpraserd, T. (2008). Thailand and the Hamburger crisis. Retrieved on June 8, 2017 from http://www.thaiworld.org/th/thailand_monitor/answer.php?question_id=814.

Kruboonyong, C. (2011). Financial statements analysis. Bangkok: SE-ED Education.

Mun, S. G. & Jang, S. S. (2015). Working capital, cash holding and profitability of restaurants firms. School of Hospitality and Tourism Management, Purdue University, USA. https://doi.org/10.1016/j.ijhm.2015.04.003

Prachayasakul, S. (2014). Relationship between working capital management and firm profitability of listed companies in The Stock Exchange of Thailand. Master of Accountancy, Chiang Mai University.

Prasitsutthiporn, P. (2010). The relationship between working capital management and profitability of sampled SET listed companies. Master of Business Administration, Major Field: Business Administration, Financial M.B.A., Kasetsart University.

Pornchaloempong, P. & Rattanapannon, N. (2016). Food industry. Retrieved on August 1, 2017 from http://www.foodnetworksolution.com/wiki/word/2561/.

Securities and Exchange Commission, Thailand. (2017). List of companies listed on the Thailand Exchange. Retrieved on April 24, 2017 from http://www.set.or.th/th/company/ companylist.html.

Singhania, M., Sharma, N. & Rohit, J. Y. (2014). Working capital management and profitability: evidence from Indian manufacturing companies. Faculty of Management Studies, FMS, University of Delhi, India. https://doi.org/10.1007/s40622-014-0043-3

Tuwanimitkun, P. (2005). Business finance. Pathum Thani: Advance Control Limited.

Ukaegbu, B. (2014). The impact of working capital management on firm profitability in different business cycles: evidence from Finland. London Metropolitan Business School, London Metropolitan University, United Kingdom.

Vorraprasittikun, S. (2010). The impacts of working capital management on business profitability of the wood furniture industry of Thailand. Master of Arts (Agribusiness), Major Field: Agribusiness, Department of Agricultural and Resource Economics, Kasetsart University.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 https://creativecommons.org/licenses/by-nc-nd/4.0/

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.