Financial Literacy: What is it and why does it matter?

Keywords:

Financial Literacy, Financial Knowledge, Financial Attitude, Financial BehaviorAbstract

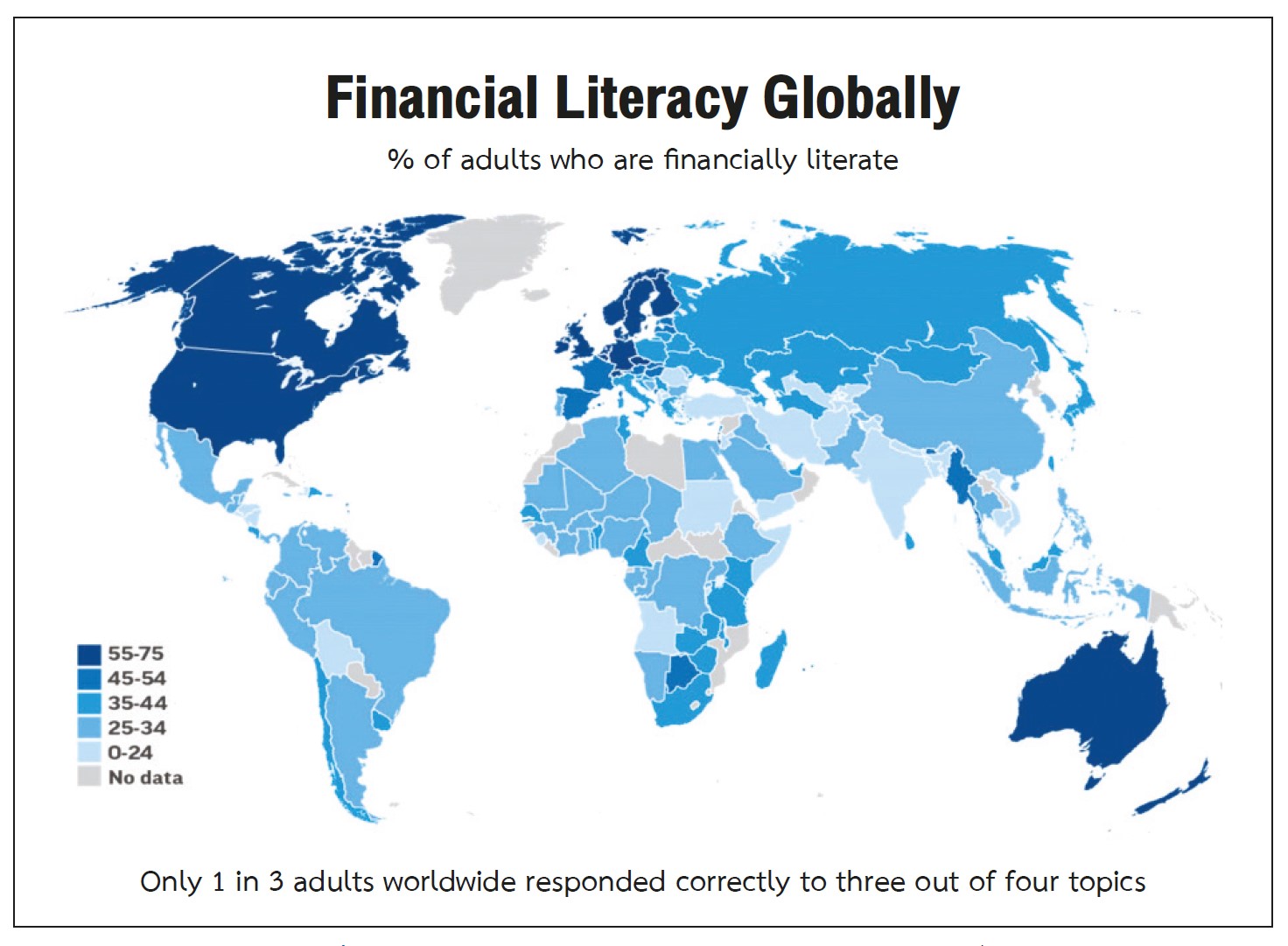

Evidence from surveys have shown that the financial literacy of people in many countries around the world is at a low level. Studies in Thailand by the OECD, and also by the Bank of Thailand in collaboration with the National Statistical Office of Thailand have shown a similar outcome. Realizing that the benefits of financial literacy are crucial foundation for enhancing quality of life, many public and private organizations have focused on improving people’s level of financial literacy. This research aims to describe the measurement of financial literacy in terms of financial knowledge, financial attitude and financial behavior. The most influential component was sound financial behaviors. If the government wishes to raise the level of financial literacy, it must change the attitudes of people to the point that can transform their behaviors. Additionally, people need to be able to effectively apply their knowledge to real life situations. In other words:“once knowledge is thoroughly understood, it can be effectively applied.”

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2020 https://creativecommons.org/licenses/by-nc-nd/4.0/

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.