Patterns of Cash Flows Information and Its Relationship with Stock Prices of the Listed Companies in Thailand

Keywords:

Cash Flow Patterns, Net Cash Flows, Operating Activities, Investing Activities, Financing Activities, Stock PriceAbstract

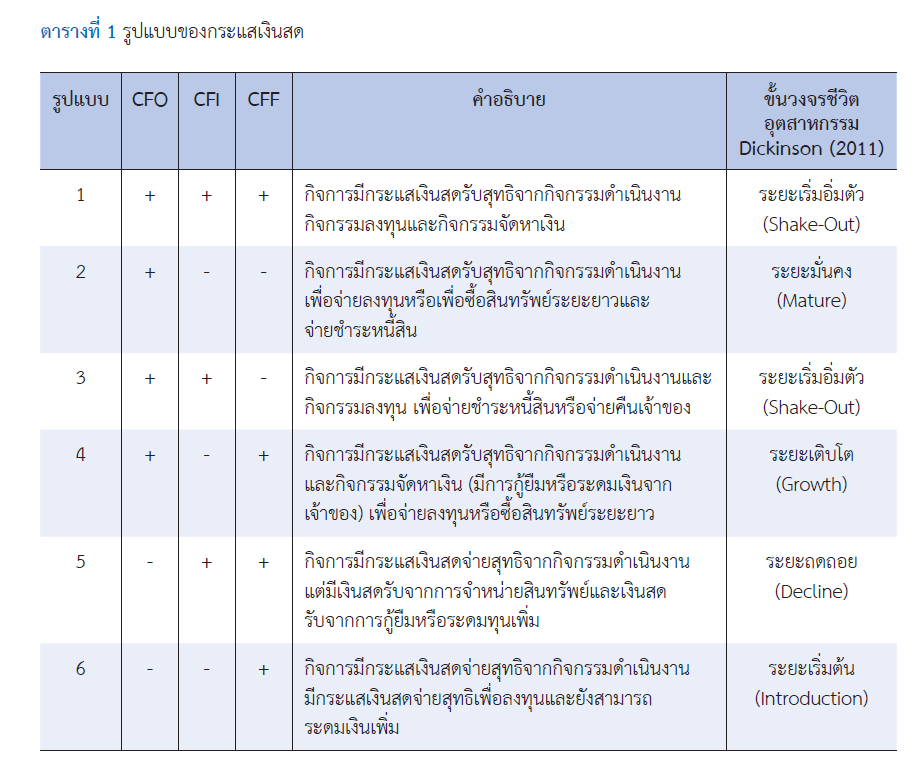

This study explores patterns of cash flows information of the Thai Listed Companies during 2017-2022. The sample was divided into eight groups based on the signs on cash flows from each activity and assigned the levels of industry life cycle. This study finds that the pattern of the largest group is in shake-out stage. Mostly, the results show positive relationship between net cash flows from operations and stock prices in various patterns. The results also show positive relationship between net cash flows from investing activities and stock prices in the shake-out stage. In the group with negative net cash flows from financing activities, and positive net cash flows from operation, net cash flows from financing activities has negative relationship with stock prices, while the rest of the sample shows positive relationship. This study concludes that cash flows information should not be interpreted from the sign of each item separately. It should be used integratedly and holistically.

References

Aitsareetaanchanok, N., & Terdpaopong, K. (2025). Relationship between cash flows ratios and stock prices of companies listed on the Stock Exchange of Thailand during the coronavirus 2019 situation. Business Administration and Economics Review, 21(1), 17–31. https://so15.tci-thaijo.org/index.php/bae/article/view/985

Barth, M. E., Beaver, W. H., & Lansman, W. R. (2001). The relevance of the value relevance literature for financial accounting standard setting: Another view. Journal of Accounting and Economics, 31(1–3), 77–104. https://doi.org/10.1016/S0165-4101(01)00019-2

Basu, S. (1997). The conservatism principle and the asymmetric timeliness of earnings. Journal of Accounting and Economics, 24(1), 3–37. https://doi.org/10.1016/S0165-4101(97)00014-1

Bowen, R. M., Burgstahler, D., & Daley, L. A. (1986). Evidence on the relationships between earnings and various measures of cash flow. The Accounting Review, 61(4), 713–725.

Chaiwongsakda, N., Kasorn, K., & Kuntawang, T. (2023). Correlated factors to stock value as market price and dividend payout ratio of real estate and construction industry companies registered in the Stock Exchange of Thailand. Interdisciplinary Academic and Research Journal, 3(2), 605–620. https://doi.org/10.14456/iarj.2023.93

Daorueng, A., et al. (2020). The relationship between intangible assets, cash flow, and firm performance on stock price of listed companies in the stock exchange of Thailand. Graduate School Journal Chiang Rai Rajabhat University, 13(1), 45–65. https://so01.tci-thaijo.org/index.php/crrugds_ejournal/article/view/229718

Dechow, P. M. (1994). Accounting earnings and cash flows as measures of firm performance: The role of accounting accruals. Journal of Accounting and Economics, 18(1), 3–42. https://doi.org/10.1016/0165-4101(94)90016-7

Dickinson, V. (2011). Cash flow patterns as a proxy for firm life cycle. The Accounting Review, 86(6), 1969–1994. https://doi.org/10.2308/accr-10130

Garrison, R. H., Noreen, E. W., Brewer, P. C., Cheng, N. S., & Yuen, K. C. K. (2015). Managerial accounting (Asia global ed., 2nd ed.). McGraw-Hill Education.

Inlom, K., & Seangkhiew, P. (2023). Influence of asset management efficiency and profitability on stock prices and dividend yields of companies listed on the Stock Exchange of Thailand: Agro-industry, food industry, and resource industry group. Journal of Management and Local Innovation, 5(7), 48–61. https://so06.tci-thaijo.org/index.php/jmli/article/view/264256/178532

Judsang, K., Sealai, N., & Thanasetpakin, C. (2024). The relationship between accounting information and securities prices of listed companies in the Stock Exchange of Thailand: Medical index services industry. KRIS Journal, 4(2), 41–50. https://so08.tci-thaijo.org/index.php/KRIS/article/view/4100

Junkav, S., & Boonmunewai, S. (2024). Compare the relation of accounting performance on the stock price of listed companies in the Market for Alternative Investment before and during the COVID-19 crisis situation. RMUTI Journal Humanities and Social Sciences, 11(1), 52–63. https://so05.tci-thaijo.org/index.php/RMUTI_SS/article/view/268715

Kanta, P., Chuamaungphan, O., & Akarak, P. (2025). The influence of cash flow and financial liquidity on the firm value of listed companies in the Stock Exchange of Thailand Set100. Academic Journal of North Bangkok University, 14(1), 57–66. https://so01.tci-thaijo.org/index.php/NBU/article/view/276938

Kitnopsri, N., & Jarutakanont, S. (2022). The ability of accounting performance measures to explain security price. Humanities and Social Science Research Promotion Network Journal, 5(3), 47–67. https://so06.tci-thaijo.org/index.php/hsrnj/article/view/259622

Kobkanjanapued, Y., & Tripattanasit, P. (2023). The value relevance of accounting information of listed companies in ASEAN countries. Arts of Management Journal, 7(4), 1618–1643. https://so02.tci-thaijo.org/index.php/jam/article/view/266328

Livnat, J., & Zarowin, P. (1990). The incremental information content of cash-flow components. Journal of Accounting and Economics, 13(1), 25–46. https://doi.org/10.1016/0165-4101(90)90066-D

Narktabtee, K. (2000). The implication of accounting information in the Thai capital market (Doctoral dissertation). University of Arkansas.

Narktabtee, K., Carnes, T. A., & Black, E. L. (2002). The effects of earnings and cash flow permanence on their incremental information content in Thailand. Asia-Pacific Journal of Accounting & Economics, 9(1), 1–16. https://doi.org/10.1080/16081625.2002.10510597

Ohlson, J. A. (1995). Earnings, book values, and dividends in equity valuation. Contemporary Accounting Research, 11(2), 661–687. https://doi.org/10.1111/j.1911-3846.1995.tb00461.x

Phetphanngam, N., & Yangklan, P. (2025). The relationship between tax planning, dividend policy, and cash flow on investment decisions of listed companies in the SET100 index of the Stock Exchange of Thailand. Journal of Administration Management and Sustainable Development, 3(3), 1302–1316. https://so15.tci-thaijo.org/index.php/jamsd/article/view/1980

Rayburn, J. (1986). The association of operating cash flow and accrual with security returns. Journal of Accounting Research, 24(3), 112–133. https://doi.org/10.2307/2490732

Siripong, W., Sariddeeperaphan, K., & Suttipun, M. (2018). An influence of cash flow on profitability and market price: A study of Market for Alternative Investment (MAI). Princess of Naradhiwas University Journal of Humanities and Social Sciences, 5(2), 111–120. https://so05.tci-thaijo.org/index.php/pnuhuso/article/view/133578

Sowanna, S., & Bursakornnat, S. (2023). The effects of cash flows and capital structure on stock prices and dividend yields of companies listed on the Stock Exchange of Thailand service industry group. Journal of Legal Entity Management and Local Innovation, 9(7), 289–302. https://so04.tci-thaijo.org/index.php/jsa-journal/article/view/265456

Stice, E. K., Stice, J. D., Albrecht, W. S., Swain, M. R., Duh, R.-R., & Hsu, A. W. (2021). Financial accounting: IFRS edition (3rd ed.). Cengage Learning Asia Pte Ltd.

Thooltaisong, T., & Boonmunewai, S. (2019). The relationship between book value, operating income, net income, cash flow from dividend, and cash flow from operations and stock price of firms listed in the Stock Exchange of Thailand. KKBS Journal of Business Administration and Accountancy, 3(1), 73–90.

Unthanon, T., & Mokkhavesa, B. (2022). The relationship between cash flow, market capitalization, and the ratio of change in securities prices of listed companies in the Stock Exchange of Thailand. Journal of Management Science Udon Thani Rajabhat University, 4(5), 81–93. https://so08.tci-thaijo.org/index.php/MSJournal/article/view/2822

Watcharanukul, K. (2022). Relationship between fair values and stock price of listed firms in the Stock Exchange of Thailand. KKBS Journal of Business Administration and Accountancy, 6(2), 36–47. https://so04.tci-thaijo.org/index.php/kkbsjournal/article/view/249463

Watcharanukul, K., & Kaewprapa, K. (2016). The relationship between earnings component information and stock price of listed firms in the Stock Exchange of Thailand. Parichart Journal, 28(3), 230–249. https://so05.tci-thaijo.org/index.php/parichartjournal/article/view/56035

Wilson, G. P. (1986). The relative information content of accruals and cash flows: Combined evidence at the earnings announcement and annual report release date. Journal of Accounting Research, 24(3), 165–203. https://doi.org/10.2307/2490736

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 NIDA Business School, National Institute of Development Administration

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.