Long-Run Equilibrium Relationship Between the Banking Stock Price index and Macroeconomic and Financial Variables: ARDL Approach

Keywords:

Banking Stock Price Index, Macroeconomic, Financial, Long-Run Equilibrium RelationshipAbstract

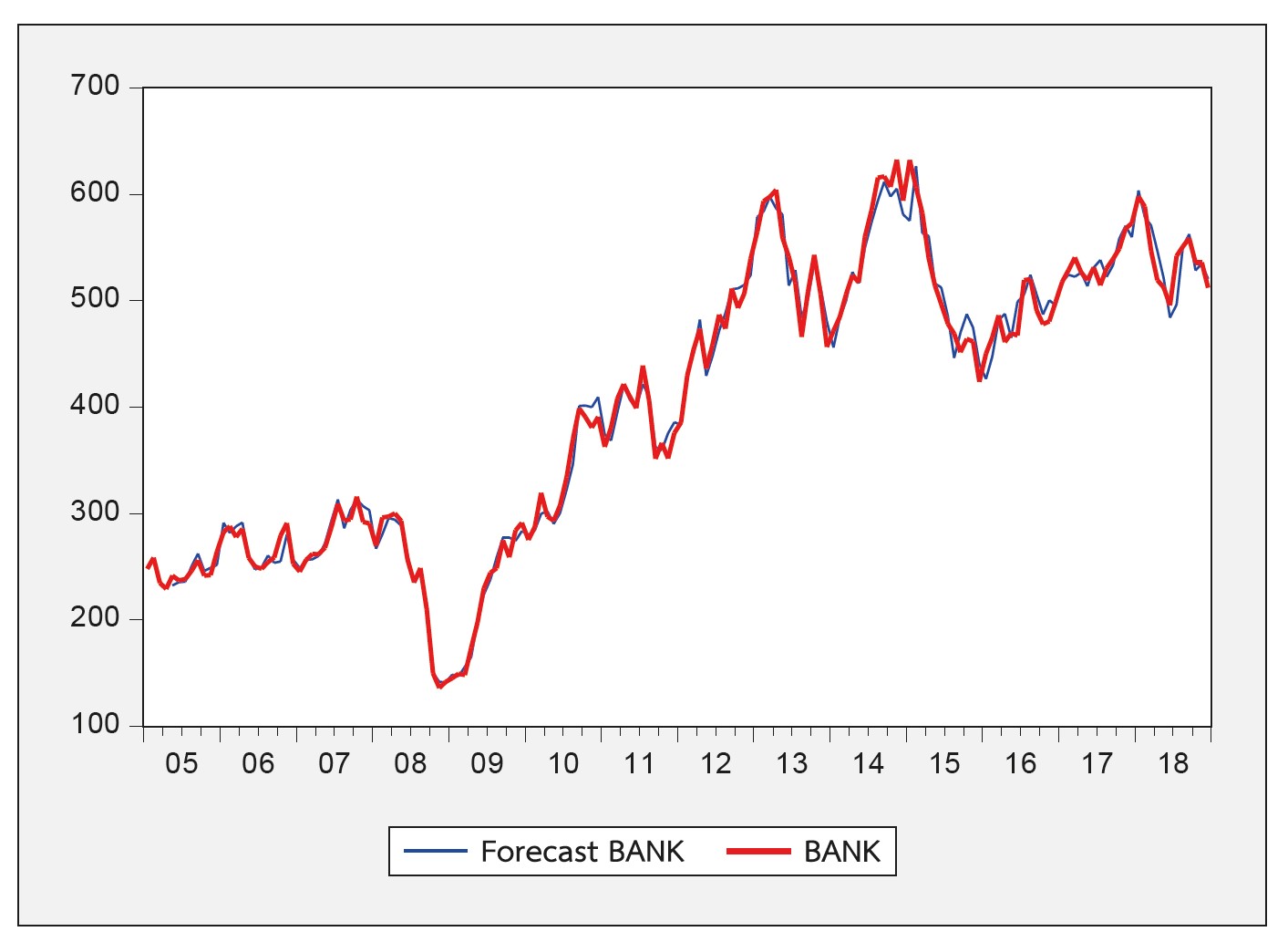

The objective of this research is to test the long-term equilibrium relationship between the banking stock price index and macroeconomic and financial variables, including 12 variables. Based on the test methodology of Pesaran et al. (2001), it showed there exist long-run relationship equlibrium among those variables. The variables significantly affecting the banking stock price index in the long-run are the stock price index of Thailand, general consumer price index, Gross Domestic Product, Federal Fund Rate and the ratio of non-performing loans to total loans.

References

Banruelit, B. (2011). Economic factors affecting stock market index of commercial banks in the Stock Exchange of Thailand. (Independent Study) Bangkok: Rajamangala University of Technology Thanyaburi.

Chancharat, S. and Saengsai, H. and Ruchirarungsan, K. (2017). The relationship between exchange rates and the yields of the Stock Exchange of Thailand. WMS Journal of Management Walailak University Vol.6 No.2 (May – August 2017 ): Page 1-6

Chow, G. C. and A.-L. Lin (1971). Best Linear Unbiased Interpolation, Distribution, and Extrapolation of Time Series by Related Series. Review of Economics and Statistics, Vol. 53, 372-375.

Hasim, S. and Srihera, R. (2014). The rationale between the stock exchange price index and foreign exchange rates: a case study in Thailand Science and Technology Journal, Vol. 22, No. 3 (July-September) 2014: Page 306-316

Johansen, S. (1995). Likelihood-Based Inference in Cointegrated Vector Autoregressive Models. Oxford: Oxford University Press.

Kiatthanawit, B. (1991). Economic factors influencing prices of commercial banks and finance and securities companies (Witthaya Nip). Bangkok: Thammasat University.

Lertchana, W. (2011). Long-term equilibrium relationship between the Stock Exchange of Thailand price index and Stock Exchange Index in East Asia (Independent Study) Khon Kaen: Khon Kaen University.

Mekvatana, K. and Rangkakulnuwat, P. (2017). Long-Run Relationship Between Personal Hosing Loan and Economic Growth, Applied Economics Journal, 24 (1), 38–59.

Pesaran, M. H. and Y. Shin (1999). An autoregressive distributed lag modelling approach to cointegration analysis. Chapter 11 in Econometrics and Economic Theory in the 20th Century: The Ragnar Frisch Centennial Symposium, Strom S (ed.). Cambridge University Press: Cambridge

Pesaran, M. H., Shin Y., and R. J. Smith (2001). Bounds Testing Approaches to the Analysis of Level Relationships. Journal of Applied Econometrics, 16, 289-326.

Phromchan, A. and Banchuenwijit, W. (2013). Factors affecting the share price of Kasikorn Bank Public Company Limited. Financial, Banking and Investment Journal, Vol.1, No. 3 (July - September 2013): Page 126 -141

Poommarin, K. and Rangkakulnuwat, P. (2560) Long-Run Relationship Between Insurance Index and Economic Factors, The 13th National Graduate Research Conference, 2018

Pornsuksawang, S. (2012). Economics of financial markets. 1st edition, Bangkok, Thammasat University Press.

Rangkakulnuwat, P. (2016). Introduction to Econometrics (4th ed.). Bangkok: Chulalongkorn University Press.

Rangkakulnuwat, P. (2016). Macroeconomics Theory II. Bangkok: Chulalongkorn University Press.

Rangkakulnuwat, P. (2013). Time Series Analysis for Economics and Business. Bangkok: Chulalongkorn University Press.

Rojanawuttithitikun, A. (2011). Factors Affecting Securities Prices of Commercial Banks in the Stock Exchange of Thailand (Thesis), Bangkok: Srinakharinwirot University.

Somnuek, S. and Kokong, P. (2016). The Relationship between Macroeconomic Factors and Stock Market Returns in Thailand (Research) Chon Buri, Department of Economics, Faculty of Humanities and Social Sciences: Burapha University.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2020 https://creativecommons.org/licenses/by-nc-nd/4.0/

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.