Moderating Effect of Corporate Governance and Ownership Structure on Relationship Between Cash Holdings and Firm Performance

Keywords:

Moderating effect, corporate governance, state ownership, family ownership, ownership concentration, competitive conditions, economic conditionsAbstract

This study investigates the moderating effect of corporate governance and ownership structure on the relationship between cash holdings and firm performance. The factors of the study include corporate governance, state ownership, family ownership, ownership concentration, competitive conditions, and economic conditions, by considering a sample of publicly listed companies on The Stock Exchange of Thailand from 2011 to 2020. The dataset used in this study comprises 4,611 observations from 483 firms, which were examined through fixed-effect panel regression analysis. The results of this study show that the factors of economic conditions and family ownership do not significantly moderate the relationship of cash holdings and firm performance, which differs from the hypothesis. Meanwhile, the factors of corporate governance and ownership concentration exhibit a negative moderating effect on this relationship. Furthermore, the factors of state ownership and competitive conditions positively moderate the relationship of cash holdings and firm performance.

References

Alnori, F. (2020). Cash holdings: Do they boost or hurt firms' performance? Evidence from listed non-financial firms in Saudi Arabia. International Journal of Islamic and Middle Eastern Finance and Management, 13(5), 919-934. https://doi.org/10.1108/IMEFM-08-2019-0338

Ang, J.S. and Ding, D.K. (2006). Government ownership and the performance of government linked companies: The case of Singapore. Journal of Multinational Financial Management, 16(1), 64-88. https://doi.org/10.1016/j.mulfin.2005.04.010

Ashhari, Z.M. and Faizal, D.R. (2018). Determinants and performance of cash holding: evidence from small business in malaysia. International Journal of Economics, Management and Accounting, 26(2), 457-473.

Boardman, A.E. and Vining, A.R. (1989). Ownership and performance in competitive environments: A comparison of the performance of private, mixed, and state-owned enterprises. The Journal of Law and Economics, 32(1), 1-33. https://doi.org/10.1086/467167

Business Today. (2020). Enhancing Cash Management Efficiency in the COVID-19 Crisis Era. Retrieved Aug 19, 2023, from https://www.businesstoday.co/opinions/26/08/2020/48439/ (Aug 19, 2023)

Ferreira, M.A. and Matos, P. (2008). The colors of investors' money: The role of institutional investors around the world. Journal of Financial Economics, 88(3), 499-533. https://doi.org/10.1016/j.jfineco.2007.07.003

Gedajlovic, M., Carney, M., Chrisman, J.J. and Kellermanns, F.W. (2012). The adolescence of family firm research: Taking stock and planning for the future. Journal of Management, 38, (4), 1010-1037. https://doi.org/10.1177/0149206311429990

Ghaly, M., Dang, V.A. and Stathopoulos, K. (2015). Cash holdings and employee welfare. Journal of Corporate Finance, 33(1), 53-70. https://doi.org/10.1016/j.jcorpfin.2015.04.003

Hasan, I., Kobeissi, N., Liu, L. and Wang, H. (2018). Corporate social responsibility and firm financial performance: the mediating role of productivity. Journal of Business Ethics, 149(3), 671-688. https://doi.org/10.1007/s10551-016-3066-1

Hu, H.W., Tam, O.K. and Tan, M.G. (2009). Internal governance mechanisms and firm performance in China. Asia Pacific Journal of Management, 27, 727-749. https://doi.org/10.1007/s10490-009-9135-6

Heracleous, L. (2001). What is the impact of corporate governance on organisational performance?. Corporate Governance: An International Review, 9(3), (July)165-173. https://doi.org/10.1111/1467-8683.00244

Jisaba, J. (2020). Industry Peer Effects on Cash Holding of Listed Companies in The Stock Exchange of Thailand. An Independent Study, Chiang Mai University.

Lamida, K. (2020). Assessment of Good Corporate Governance and Firm Value of The Listed Companies on The Stock Exchange of Thailand. Journal of Buddhist Anthropology, 5(9), 425-441.

Le, T.P.V. and Phan, T.B.N (2017). Capital structure and firm performance: empirical evidence from a small transition country. Research in International Business and Finance, 42(1), 710-726. https://doi.org/10.1016/j.ribaf.2017.07.012

Lee, K.W. and Lee, C.F. (2009). Cash holdings, corporate governance structure and firm valuation. Review of Pacific Basin Financial Markets and Policies, 12(3), 475-508. https://doi.org/10.1142/S021909150900171X

Margaritis, D. and Psillaki, M. (2010). Capital structure, equity ownership and firm performance. Journal of Banking and Finance, 34(3), 621-632. https://doi.org/10.1016/j.jbankfin.2009.08.023

Martínez-Sola, C., García-Teruel, P.J. and Martínez-Solano, P. (2013). Corporate cash holding and firm value. Applied Economics, 45(2), 161-170. https://doi.org/10.1080/00036846.2011.595696

Mikkelson, W.H. and Partch, M.M. (2003). Do persistent large cash reserves hinder performance?. The Journal of Financial and Quantitative Analysis, 38(2), 275-294. https://doi.org/10.2307/4126751

Monchai, M. (2021). The Cash Flow Cycle: The Heart of Business Survival. Retrieved Aug 19, 2023, from https://www.setinvestnow.com/th/knowledge/article/281-cash-cycle-for-business-liquidity (Aug 19, 2023)

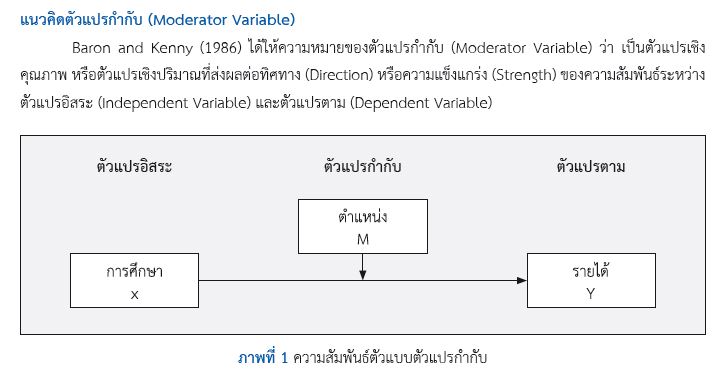

Montree, P. (2015). Moderator and mediator in Structural Equation Modeling. The Journal of Industrial Technology, 11(3), 83-96.

Myers, S.C. and Rajan, R.G. (1998). The paradox of liquidity. The Quarterly Journal of Economics, 113(3), 733-771. https://doi.org/10.1162/003355398555739

Nisanart, K. (2017). Relationship Between Board Characteristics and Performance of Listed Firms in Market for Alternative Investment. An Independent Study, Chiang Mai University.

Opler, T., Pinkowitz, L., Stulz, R. and Williamson, R. (1999). The determinants and implications of corporate cash holdings. Journal of Financial Economics, 52(1), 3-46. https://doi.org/10.1016/S0304-405X(99)00003-3

Ozkan, A. and Ozkan, N. (2004). Corporate cash holdings: An empirical investigation of UK companies. Journal of Banking & Finance, 28(9), 2103-2134. https://doi.org/10.1016/j.jbankfin.2003.08.003

Paniagua, J., Rivelles, R. and Sapena, J. (2018). Corporate governance and financial performance: the role of ownership and board structure. Journal of Business Research, 89(1), 229-234. https://doi.org/10.1016/j.jbusres.2018.01.060

Phattrapong, C. (2017). Corporate Governance Scoresand Roles of Determinantsin Firm Values of the Companies Listed in Thailand. MUT Journal ofBusiness Administration, 14(1), 1-24.

Poza, E.J. (2010). Family business. (3rd ed.). Mason, OH: Thomson South-Western.

Rumpaporn, U. (2016). Relationship between cash holdings and firm value: evidence from the Stock Exchange of Thailand. An Independent Study, Thammasat University.

Sirirath, B. (2014). A Causal Model for Financial Performance of Family Business after Transgeneration in Thailand. Dissertation, Sripatum University

Song, K. and Lee, Y. (2012). Long-term effects of a financial crisis: evidence from cash holdings of east asian firms. Journal of Financial and Quantitative Analysis, 47(3), 617-641. https://doi.org/10.1017/S0022109012000142

Wang, Y.J. (2002). Liquidity management, operating performance, and corporate value: evidence from Japan and Taiwan. Journal of Multinational Financial Management, 12(2), 159-169. https://doi.org/10.1016/S1042-444X(01)00047-0

Warissara, R. and Yordying, T. (2019). Relationship between Ownership Concentration and Dispersion and Stock Liquidity of the Listed Companies in the Stock Exchange of Thailand. Journal of Administration and Management, 9(1), 137-152.

Yun, J., Ahmad, H., Jebran, K. and Muhammad, S. (2020). Cash holdings and firm performance relationship: Do firm-specific factors matter?. Economic Research-Ekonomska Istraživanja, 34(1), 1283-1305. https://doi.org/10.1080/1331677X.2020.1823241

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 NIDA Business School, National Institute of Development Administration

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.